The company also reported a net profit in the first half of fiscal year 24 and said it plans to maintain its profitable streak and continue to show strong financial results.

The company’s borrowing operating expenses soared sharply during the year, increasing 294% to Rs 270 crore from Rs 68.5 crore in FY23.

Interestingly, its payment processing expenses (critical for any payments company) are now lower at Rs 200 crore. In the last year, they grew at a slower pace from Rs 148 crore in FY23.

Mobikwik has been focused on building a larger company financial The services are based on credits and mutual funds offered along with mobile wallet and UPI payments. According to data from the National Payments Corporation of India, The company processed around 9.1 million UPI payments in July.

According to business details shared in the draft red herring prospectus filed by Mobikwik in January this year, new user additions had fallen to around seven million in the first six months of fiscal year 2024. It had added 16.3 million new users in FY23.

Discover the stories that interest you

Mobikwik offers Zip EMI, which provides loans of between Rs 10,000 and Rs 200,000 directly into the customer’s bank account. It also offers its users a buy now pay later option of up to Rs 60,000.Mobikwik currently has an approval in principle from the Reserve Bank of India for the payment aggregator license, which it received in October last year.

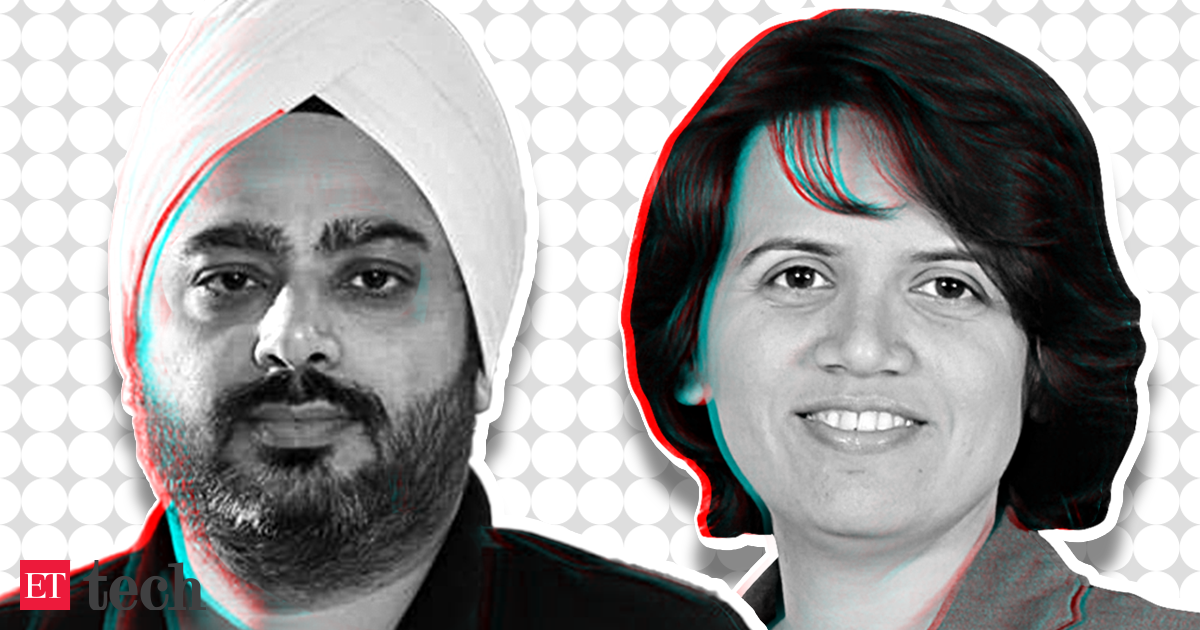

“We have made great strides in developing our products and expanding our reach to smaller cities and towns where the country is currently experiencing increased digital growth. To close the year, our business strength was driven by the growth of our user base and revenue from our financial services business,” said Upasana Taku, Co-Founder of Mobikwik.

“As we enter the new financial year, our vision is to maintain this growth trajectory by improving our products and services,” he added.

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.