Mortgage loan, loan, housing, house (Photo: Shutterstock)

Getting a loan to buy a home is an important financial decision. Even a small change in interest rates can have a substantial impact. Therefore, it is essential to compare different banks before making a final decision.

Interest rates vary and are influenced by several factors, including your creditworthiness, the amount of the loan, your professional experience, and the stature of your employer.

Click here to connect with us on WhatsApp

Business Standard has compiled a list of home loan rates currently offered by various financial institutions.

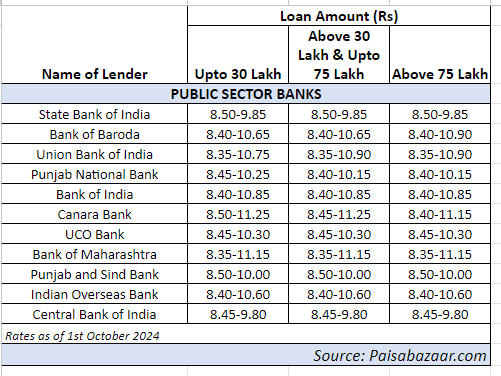

Public sector banks

Union Bank of India offers an interest rate in the range of 8.35 percent to 10.90 percent. Bank of Baroda’s interest rate ranges from 8.40 per cent to 10.90 per cent.

Punjab National Bank offers an interest rate of 8.40 percent to 10.25 percent, while Bank of India’s interest rate is between 8.40 percent and 10.85 percent.

UCO Bank has interest rates between 8.45 percent and 10.30 percent, and State Bank of India offers interest rates of 8.50 percent to 9.85 percent. Punjab and Sind Bank offer it between 8.50 percent and 10.00 percent.

Here is a selected list of home loans offered by public sector banks:

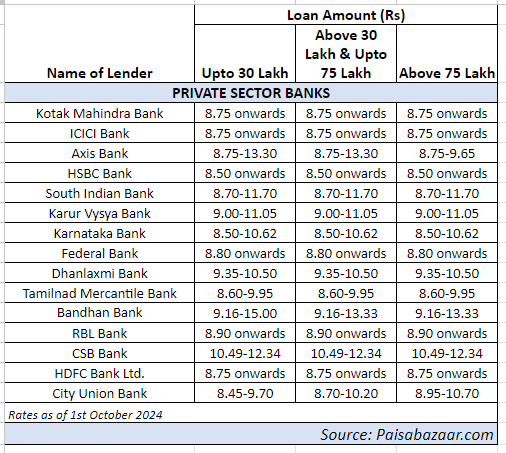

private sector banks

City Union Bank offers interest rates in the range of 8.45 percent to 10.70 percent, while HSBC Bank’s interest rate starts at 8.50 percent.

Karnataka Bank offers interest rates from 8.50 per cent to 10.62 per cent, and Kotak Mahindra Bank’s interest rate starts from 8.75 per cent.

HDFC Bank Ltd’s interest rate starts from 8.75 percent, while Axis Bank offers from 8.75 percent to 13.30 percent.

The Federal Bank offers interest rates starting at 8.80 percent.

Here is a selected list of home loans offered by private sector banks:

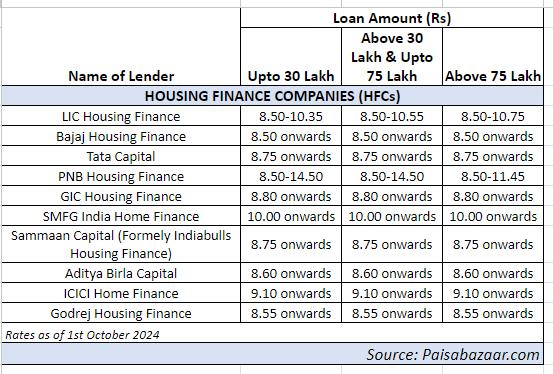

Home financing companies

LIC Housing Finance offers interest rates in the range of 8.50 per cent to 10.75 per cent, while Bajaj Housing Finance’s interest rate starts from 8.50 per cent.

The interest rate of PNB Housing Finance ranges between 8.50 percent and 14.50 percent.

The interest rate of Godrej Housing Finance starts from 8.55 per cent onwards, while that of Aditya Birla Capital starts from 8.60 per cent onwards.

Tata Capital is offering it starting at 8.75 per cent and Sammaan Capital (formerly Indiabulls Housing Finance) starting at 8.75 per cent.

The interest rate of GIC Housing Finance starts from 8.80 per cent onwards, and that of ICICI Home Finance from 9.10 per cent.

First published: October 2, 2024 | 14:03 IS

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.