While secondary transactions typically finalize at a 10-15% discount to the last primary valuation, Postman’s latest transactions are at a steep discount to their valuation, which doubled during the peak. funds 2021 cycle, underscoring the sharp decline in the value of SaaS companies in income multiples. Angel and early investors have partially sold their stakes in the Bengaluru- and San Francisco-based firm in recent rounds, the people said.

ET had reported that SaaS unicorns that are raising funds, including secondary ones, are seeing a strong correction in valuationswith some combined transactions settled at lower valuations than previous rounds.

“Virtually all SaaS companies were overvalued during the peak funding cycle. Postman has been the most valued company after its financing of 225 million dollars“And now, based on earnings projections, valuations are being repriced. There have been smaller batches of secondary stocks and there may be more in this discount range as well,” said a person familiar with the matter.

The postman did not respond to an email inquiry.

Discover the stories that interest you

Some of the startup’s existing investors have bought the shares on offer, the people said without giving further details. Nexus Venture Partners, Bond Capital and Battery Ventures are among its current investors.

According to Venture Intelligence data, SaaS investments slowed last year across all stages of the company. Late-stage SaaS companies raised $1.53 billion from private equity and venture capital funding in 2022, which fell by more than a third to $421 million in 2023. For mid-stage SaaS companies, investments fell by more than half to $920 million in 2023, down from $2.1 billion in 2022.

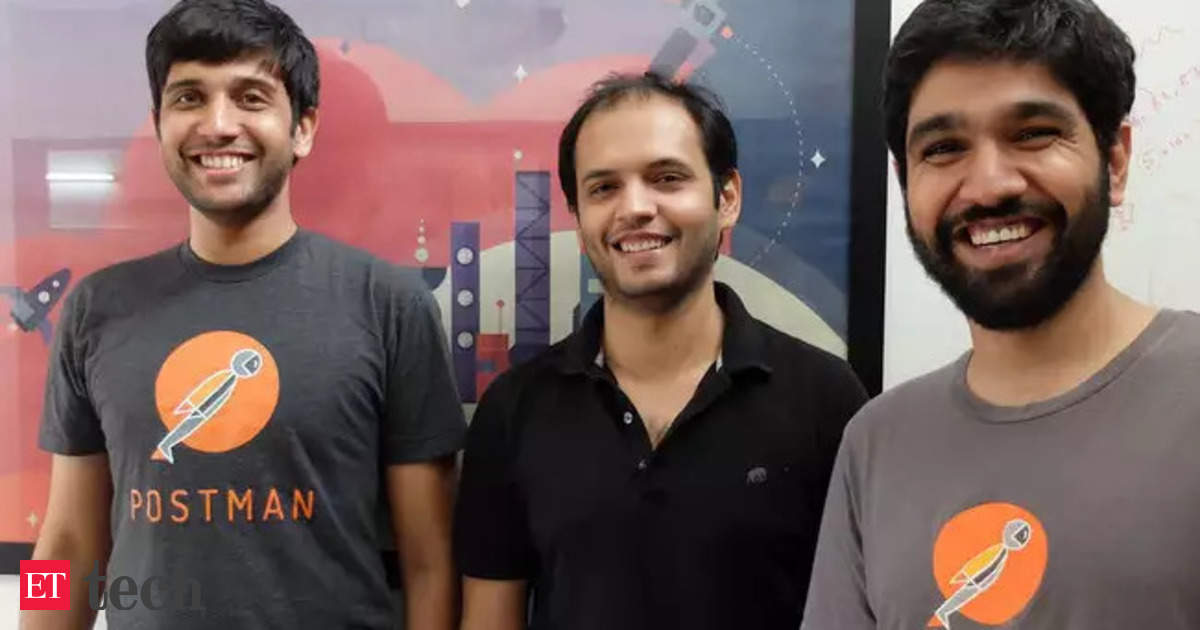

Postman is an application programming interface that started 10 years ago in Bengaluru.API) Management platform for companies. The tool allows interaction between applications and functionalities within applications.

ET was first reported in May about healthcare-focused SaaS company Innovaccer which is in talks with US-based Kaiser Permanente for a $250 million deal, which will have a combined valuation of around $2.5 billion from their last valuation of $3.2 billion.

In a secondary transaction, existing investors sell shares to new investors and the money does not go into the company’s coffers.

Revenue multiples

People familiar with Postman’s financials said the company is estimated to be posting annualized recurring revenue (ARR) of between $120 million and $150 million. “Some of the user monetization, which they thought would happen, has taken longer than expected. That has impacted the overall ARR growth rate,” one person said. Another SaaS investor echoed the same sentiment about Postman’s ARR growth.

sure, which is in talks for a new round of financinghas an ARR of around $270 million and was last valued at around $5 billion, while Innovaccer has an ARR of $130 million, ET reported in May. Whatfix, which is Warburg Pincus raises new fundshas an ARR of around $70-75 million.

In July, ET reported that Goldman Sachs was in advanced stages of talks to double its investment in MoEngage with an investment of between $35 million and $50 million through a secondary transaction.

According to a July report from investment banking firm DC Advisory, revenue multiples for publicly traded software companies with an enterprise value of more than $1 billion are currently flat at six times, trading two rounds below pre-pandemic levels.

“Growth has been under pressure over the past three years and the multiple earnings premium enjoyed by high-growth companies has narrowed substantially since the pandemic,” the report noted.

“Indian technology companies continue to trade at a three-fold revenue premium over US SaaS multiples, however, private equity providers are often reluctant to match this premium,” DC Advisory said.

According to Bessemer Venture Partners’ Nasdaq Emerging Cloud Index, SaaS company valuations tend to be 6.7 times revenue on average.

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.