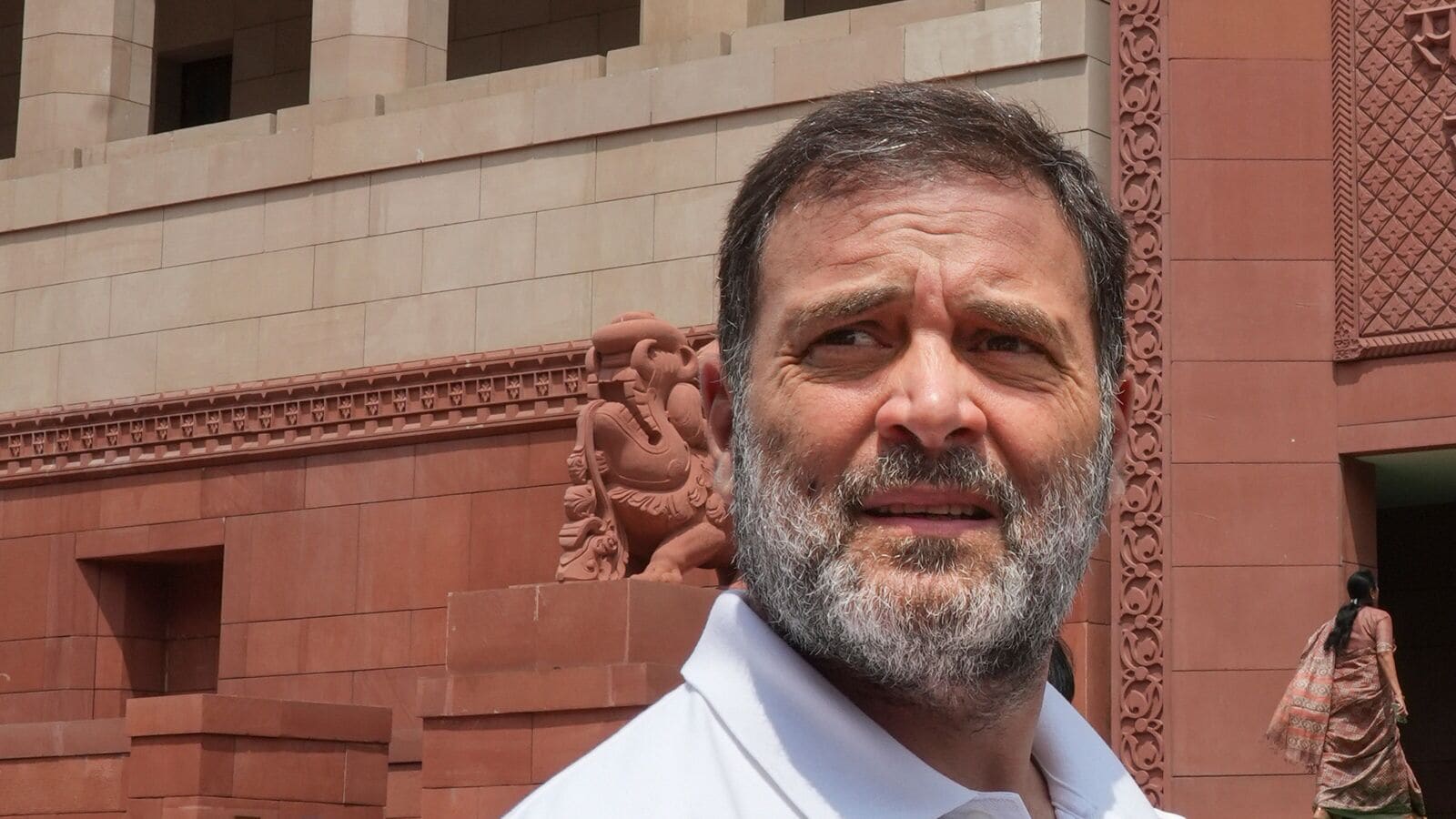

Adani-Hindenburg case: Congress MP Rahul Gandhi has said that he will soon hold a press conference to discuss Hindenburg Research’s latest salvo on the “Adani money siphoning scandal”. The Congress had on Monday intensified its attack on the Modi government over Hindenburg’s allegations against SEBI chairperson Madhabi Buch, with the Grand Old Party threatening to create a nationwide uproar if a JPC probe is not initiated.

On Tuesday, Rahul Gandhi told reporters that “one byte would not be enough” when the Leader of Opposition in Lok Sabha was asked to comment on the Hindenburg report released on Saturday, August 10.

Lok Sabha MP Rahul Gandhi said, “We will have to discuss this at length. I will hold a press conference shortly,” on his demand for a joint parliamentary committee inquiry into the Hindenburg report.

#LOOK | On his demand that the JPC conduct an inquiry into the Hindenburg report, Lok Sabha LoP Rahul Gandhi said, “We will have to discuss this at length. I will hold a press conference shortly.” image.twitter.com/GPqzFdVQpK

— AIN (@ANI) August 13, 2024

Hindenburg Research has alleged that SEBI Chairperson Madhabi Puri Buch and her husband Dhaval Buch had stakes in shady offshore funds used in the “Adani money siphoning scandal”. The allegations have been refuted by the Buch duo, who call them an attempt at “defamation” and an attack on SEBI’s credibility.

Meanwhile, Congress has pushed for the SEBI chief to resign and urged the Supreme Court to transfer the Adani probe to the CBI or a Special Investigation Team given the “likelihood of SEBI compromise”.

On Sunday, Rahul Gandhi posted a video on microblogging site X (formerly Twitter) questioning why the SEBI chief had not resigned. The Congress leader continued his tirade to ask, “If investors lose their hard-earned money, who will be responsible – PM Modi, SEBI chairman or Gautam Adani?”

“It is now abundantly clear why Prime Minister Modi is so afraid of a JPC inquiry and what it might reveal,” Gandhi added.

The integrity of SEBI, the securities regulator tasked with safeguarding the wealth of small retail investors, has been seriously compromised by the allegations against its chairman.

Honest investors across the country have urgent questions for the government:

– Because… image.twitter.com/vZlEl8Qb4b

– Rahul Gandhi (@RahulGandhi) August 11, 2024

Adani Group, the Indian conglomerate rocked by a Hindenburg Research report in 2023, faced another sharp sell-off in shares on Monday, August 12, after the US-based short-seller accused the head of India’s market regulator SEBI of having links to offshore funds also used by the group.

By the end of trading, Adani’s companies had lost $2.43 billion, or 1%, of their market value, although that was a substantial recovery from earlier losses of more than $13 billion, it said. Reuters.

The report added that shares of the group’s flagship company Adani Enterprises Shares of Adani Ports, Adani Total Gas, Adani Power, Adani Wilmar and Adani Energy Solutions closed 1.1 per cent lower on Monday, while Adani Green fell between 0.6 per cent and 4.2 per cent.

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.