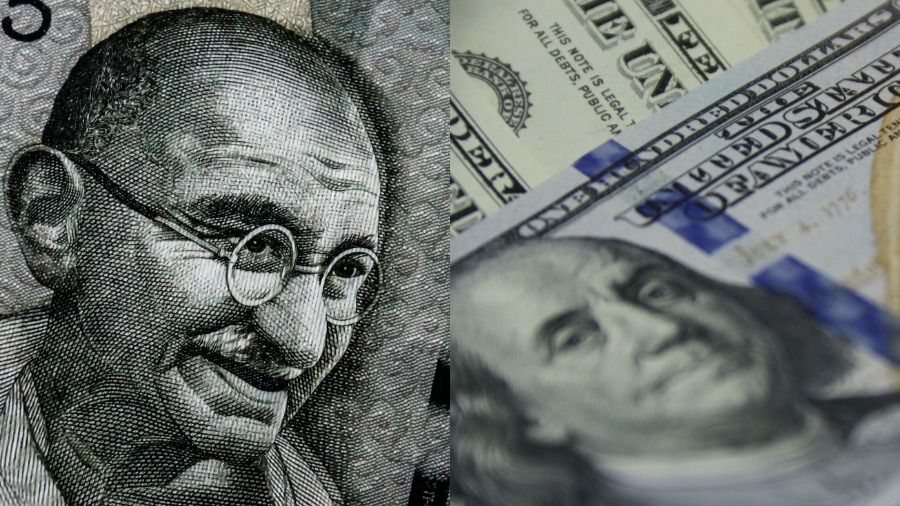

Rupee against Dollar: The Indian Rupee It is likely to start stable on Thursday, showing little reaction to the dovish minutes of the latest US Federal Reserve meeting that failed to boost sentiment towards Asian currencies.

The 1-month non-deliverable forward (NDF) for the Rupee It noted that its opening levels were trading close to Wednesday’s close of 83.9225, implying minor effects in early trading.

He RupeeThe rupee’s recent relief rally has quickly faded, with the currency now near its record low of 83.9725 earlier this week. While it strengthened to a session high of 83.7550 during Tuesday’s trading, the rupee has retreated on fresh hedging measures by importers and reduced portfolio inflows.

A currency trader at a major bank said: “What happened yesterday took everyone by surprise; it just shows that the need to buy dollars is relentless.” The trader also said the short-term outlook for Rupee It is negative and we see it trading around the 84 mark.

He RupeeThe fall of has seen the Reserve Bank of India Intervene in the markets to counter any break of a key psychological level: 84 to 1.Dollar.

U.S. stocks are advancing as investors expect the Federal Reserve to cut interest rates at a meeting in September, following the release of some data on July 30 and 31, reported by several news outlets on Wednesday. The Fed said a “vast majority” of officials support lowering rates; some advocate cutting them this month.

Still, Asian currencies continued to falter after rising earlier this week amid signs of weakening. Dollar and a greater appetite for risk.

Key market indicators

- The 1 month non-deliverable Rupee The rise to 84 is much higher compared to ground levels of over 8 paise in a month.

- USA Dollar The index rose to 101.24 after a moderate drop during yesterday’s session.

- Brent crude futures rose 0.2 percent to $75.9 a barrel.

- 10-year US bond yielding 3.81 percent

- NSDL data shows foreign investors bought a net $481.6 million worth of Indian stocks as of August 21.

- According to NSDL data, foreign investors also bought a net Rs 107,700 crore worth of Indian bonds on the day.

(With contributions from Reuters.)

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.