In 2024, the SEC increased its enforcement actions against cryptocurrency companies, imposing nearly $4.7 billion in fines. This is an increase of more than 3,000% compared to 2023. The increased enforcement actions come at a time when cryptocurrency fraud losses are on the rise. Americans lost nearly $5.6 billion in cryptocurrency scams in 2023 alone. Additionally, AI-powered deepfake scams are becoming a growing threat, targeting cryptocurrency holders with sophisticated attacks, including fake videos of well-known people like Apple CEO Tim Cook.

The SEC’s record year

So far in 2024, the United States Securities and Exchange Commission (SECOND) imposed nearly $4.7 billion in compliance actions against cryptocurrency companies and executives. This represents an increase of more than 3,000% compared to 2023.

The surge in enforcement actions was largely driven by the SEC’s record $4.47 billion fine. settlement with Terraform Labs and its former CEO, Do Kwonin June. The case is the SEC’s largest enforcement action to date and contributed significantly to the regulator’s total fines for the year.

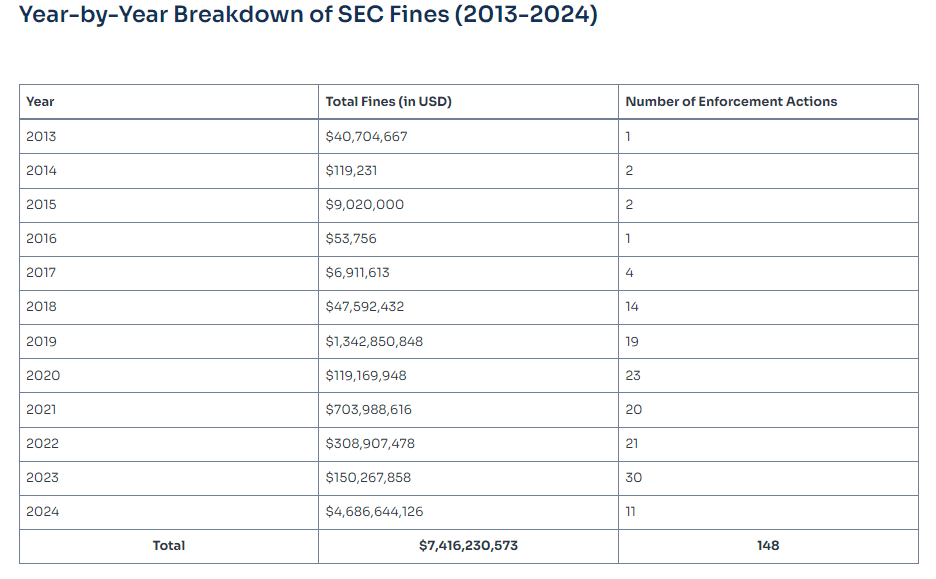

Breakdown of SEC’s annual enforcement actions and fines (Source: Social capital markets)

The SEC brought 11 enforcement actions in 2024, netting a staggering 3,018% increase over the $150.3 million in fines collected in 2023. The regulator accomplished this despite taking 19 fewer actions against crypto-related entities this year.

The total fines included forfeitures, restitution of debts, civil penalties, settlement amounts, and prejudgment interest. Looking at these numbers, it’s clear that the SEC may be shifting its strategy toward fewer but higher-impact cases. The regulator also appears to be focusing on higher-profile actions that set a precedent for the industry.

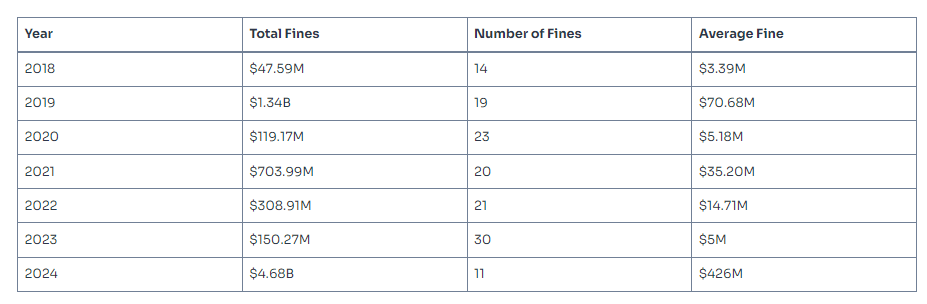

A historical comparison shows that SEC enforcement actions in the crypto space have evolved quite a bit. For example, in 2019, the SEC imposed a $1.24 billion fine on Telegram which consisted of $18.5 million in civil penalties and $1.2 billion in restitution to investors. This case significantly increased the average fine in 2019 to more than $70 million, which was an increase of almost 2,000% compared to previous years.

Average annual fine (Source: Share capital market)

Other high-profile cases include enforcement actions for more than $100 million against GTV Media Group, Ripple Labsand fraudsters John and Tina Barksdale. Despite the high fines in these high-profile cases, 46% of fines since 2020 have still been less than $1 million, with 30% falling in the $1 million to $10 million range.

Cryptocurrency fraud losses on the rise

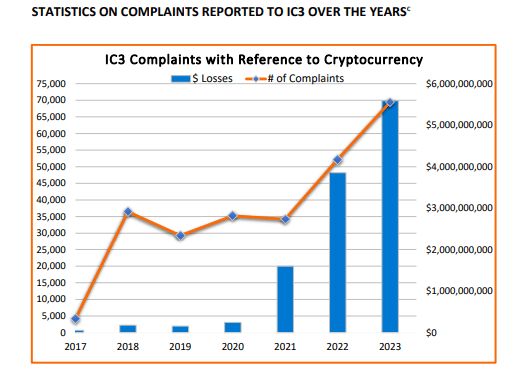

The fact that the SEC is increasing its scrutiny of the cryptocurrency sector might not be such a bad thing after all. In 2023, Americans lost $5.6 billion due to cryptocurrency fraudwhich represented a 45% increase over the previous year, according to the FBI’s Internet Crime Complaint Center. report.

Although cryptocurrency-related complaints accounted for 10% of the total complaints received, they accounted for almost 50% of the total financial losses. The report also revealed that among the 69,000 cryptocurrency-related complaints, people over the age of 60 were the most frequent victims, suffering losses totaling nearly $1.6 billion. About 71% of cryptocurrency fraud was linked to investment schemes, while about 10% involved call center fraud and scams impersonate government officials.

IC3 Complaints Regarding Cryptocurrencies (Source: FBI)

The FBI noted that many of the losses were due to scammer schemes that exploited trust and anonymity to steal funds. One key tip the FBI shared was to be wary of investment opportunities offered by people you have never met in person, as scammers typically avoid face-to-face interactions.

The FBI also warned people that Americans are vulnerable to labor trafficking, especially when they are lured into exploitative jobs overseas, such as working at call centers that run fraudulent operations like pig-slaughter scams, where workers can face passport confiscation and demands for reimbursement of employment-related expenses.

Other common fraudulent schemes include play-to-win scams, where users are tricked into purchasing tokens for online games, only to have their winnings returned. Wallets Frozen. Companies claiming to help recover lost cryptocurrencies are also causing some problems and only end up victimizing people further.

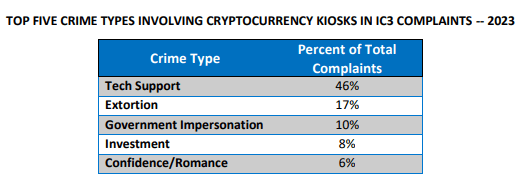

Cryptocurrency ATMs, or kiosks, also pose a serious risk for fraud. In 2023, 5,500 cases involving these kiosks resulted in losses of over $189 million. Fraudsters prefer these kiosks over banks because of the anonymity these machines offer, leading to a variety of schemes, including government impersonation, extortion, romance scamsand customer service fraud.

Top crimes involving cryptocurrency kiosks (Source: FBI)

The FBI also shared that recovering funds It is extremely difficult to lose money at cryptocurrency kiosks. FBI Criminal Investigation Division Assistant Director James Barnacle mentioned that the FBI notifies victims when it discovers fraudulent activity. Of the 3,000 notifications sent, 75% of people contacted did not even know they had been scammed.

AI-powered deepfakes pose a growing threat

Investors should also be on the lookout for new forms of fraud. As AI-powered deepfake scams become more common, security firms warn that the threat could soon extend beyond video and audio.

On September 4, software company Gen Digital reported A worrying rise in AI deepfake scams targeting cryptocurrency holders in Q2 2024. The “CryptoCore” group has already scammed over $5 million worth of cryptocurrency using these techniques. While this amount seems low compared to other methods in the crypto space, security experts are very concerned about AI Deepfake attacks could become even more sophisticated and pose a growing risk to the security of digital assets.

Web3 Security Company CertiK believes that these AI-powered scams will continue to evolve and could soon target wallets that use facial recognition to gain access to critical information. Education about the risks and tools available to counter these attacks is essential, and users should be more skeptical of unsolicited requests for money or personal information. Multi-factor authentication can also help protect against these types of scams.

Norton’s Luis Corrons is also concerned about the rise of AI-powered attacks against cryptocurrency holders. He noted that cryptocurrency transactions, which are often high-value and conducted online, are more common. anonymouslyare an attractive target for cybercriminals. The lack of regulation in the crypto space also gives hackers more opportunities and fewer legal consequences.

Despite the growing threat, there are ways to detect AI-powered deepfake attacks. Security Professionals recommend looking for red flags such as unnatural eye movements, facial expressions, and body movements, as well as a lack of emotion. Strange body shapes, facial deformation, and misaligned audio can also indicate that users are dealing with an AI deepfake.

Apple’s Tim Cook AI-powered deepfakes used in cryptocurrency scams

Experts’ concerns about deepfate technology are not unfounded. On September 9, YouTube was filled with live streams showing deepfake videos Apple CEO Tim Cook promoting cryptocurrency scams during Apple’s official iPhone 16 launch event.

In these fake broadcasts, an AI-generated version of Cook urged viewers to send Bitcoin (BTC)Ethereum (ETH), Tether (USDT), or Dogecoin (DOGE) to a specific “contribution address,” falsely promising that Apple will return twice the amount of cryptocurrency deposited. This scam is a variation on the common “double your money” scam, in which scammers pocket funds sent by unsuspecting victims.

The fraudulent streams appeared to coincide with Apple’s “Glowtime” event, which was also live-streamed on YouTube to introduce its new iPhone models. One of the fraudulent streams was broadcast from a channel imitating “Apple US,” even displaying a legitimate check mark to appear credible.

Videos and screenshots shared on X show that some of these fake streams attracted hundreds of thousands of views, though many were likely from bots designed to make the stream appear more legitimate.

YouTube Support Team recognized the problem In a post on X, users were encouraged to report the fraudulent videos through the platform’s reporting tool. The fraudulent videos have since been felledand the associated accounts have been closed.

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.