Here you will find everything you need to know about it.

Investments

LRS allows Indians to invest in listed foreign securities, both equity and debt. You can invest in mutual funds, exchange-traded funds (ETFs), hedge funds, and real estate (with some caveats). You can also invest in listed debt securities, such as bonds, but not unlisted debt.

“For example, you can invest in bond ETFs, but not in US Treasury bills as they are not publicly traded,” said Harshal Bhuta, partner at accounting firm PR Bhuta & Co.

Also read: Your credit card has been compromised. What should you do next?

You also cannot use it to buy physical gold or gold bonds outside India, although you can import gold through LRS. Furthermore, investing in derivatives listed on foreign exchanges is not permitted.

Other transactions

You can use your LRS quota for trips abroad, including business trips. You can also use it if you move abroad for work or to send money to close relatives who are non-resident Indians (NRI). Other uses include medical treatment and study abroad.

What you cannot do is create foreign currency leverage in a foreign bank. While you can technically use it to buy a property under construction abroad, you need to be careful as the RBI may see it as an infringement if the value of the construction work exceeds the LRS payment.

It cannot be used to deposit money in a fixed-term bank deposit abroad due to lack of clarity. “It appears that investment in offshore fixed deposits is not specified in the list of permitted investments. However, it is also not in the list of investments that are not permitted,” said Prakash Hegde, a chartered accountant in Bengaluru.

Also read: Banking credit lessons from the Japanese experience

Additionally, you cannot send borrowed funds abroad through LRS. “Funds being remitted under LRS must be your property if the remittance is for a capital account transaction,” said Rutvik Sanghvi, partner at Rashmin Sanghvi & Associates.

With the exception of bank accounts, you cannot gift an LRS-funded asset or investment to a non-resident.

See full image

See full image

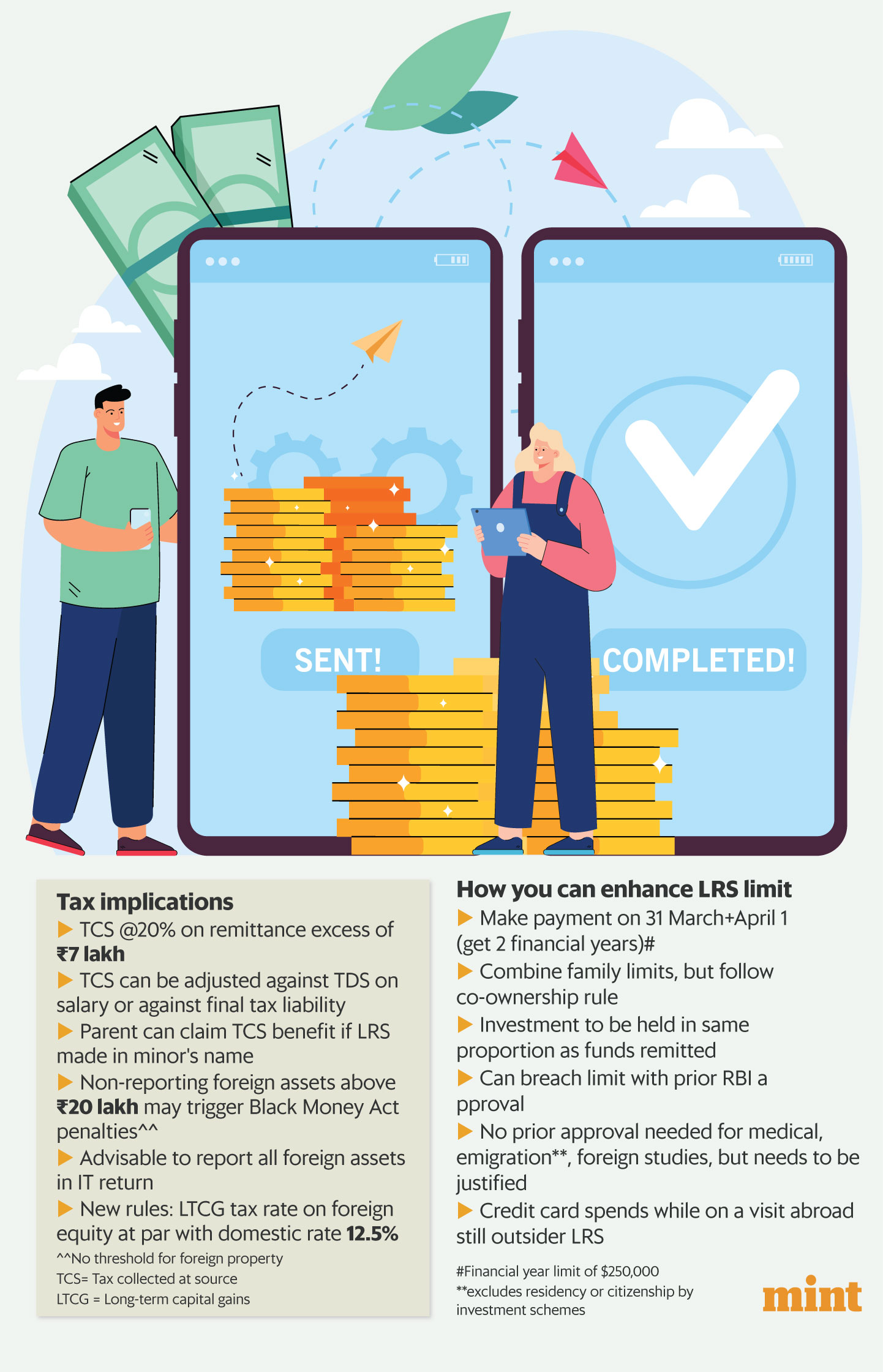

Improving the limits

The RBI has a limit of $250,000 ( $2.07 crore) per financial year per individual as per LRS. But there are ways to send more in a calendar year.

If you send one payment before March 31 and the next after April 1, you will get the benefit of two financial years. Therefore, you can send up to $500,000 in a given calendar year.

You can also pool your family members’ LRS dues to get a higher limit. But remember: if a husband and wife send money to a bank account for an investment, the investment must be made in the same proportion in which the funds were sent. If the investment is not proportionate, it results in gifts from one resident to another outside India, which is not permitted.

Also read | Vacation in France: a dream trip, but an expensive splurge

You can even seek prior approval from the RBI if you want to exceed the financial year limit. For things like overseas education, medical treatment, emigration (except residency/citizenship through investment schemes), prior approval from the RBI is not required but needs to be substantiated with appropriate documents.

Tax implications

There is a 20% tax collected at source (TCS) on the LRS transactions mentioned above. $7 lakh in a financial year. For example, if you send $8 lakh on road, the government will charge you 20% of the excess $1 lakh.

The new budget rules, however, allow the TCS credit to be deducted from the tax deducted at source (TDS) from your salary. This means that an individual taxpayer does not need to wait until the end of the financial year and can declare TCS with his employer.

Also read: GIFT City is not just for NRIs and foreigners – it has something for everyone

Although the new budget rules say not to declare foreign assets under $20 lakh will not attract penalties under the Black Money Act, it is still mandatory to disclose all such assets in your income tax return.

A2 form

To avail LRS, you need to submit Form A2 to your Authorized Dealer (AD) and mention the purpose code. Remittances from transactions under LRS are reported to the RBI on a daily basis.

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.