Binance saw the steepest drop, while Crypto.com saw impressive growth. Despite the slowdown, open interest increased following the US Federal Reserve’s latest interest rate cut. Meanwhile, a Binance research report flagged concerns over overvaluation and centralization of token ownership, which could threaten the stability of the crypto market. Despite the drop in trading volumes, Kraken recently expanded its services by launching a derivatives platform in Bermuda. Coinbase is still dealing with its legal battle against the SEC and requested communications from the CFTC to defend itself against the charges the SEC brought against the exchange.

CEX Trading Activity Slows Down

In September, there was a notable decline in trading activity in centralized markets. cryptocurrency exchanges. In fact, spot and derivatives trading volumes fell 17% to $4.34 trillion, according to the latest report. report by CCData.

This was the lowest monthly trading volume since June and was largely due to the end of the seasonality period, which typically sees reduced market participation. Both the spot and derivatives markets faced huge declines as traders stayed on the sidelines due to macroeconomic uncertainty.

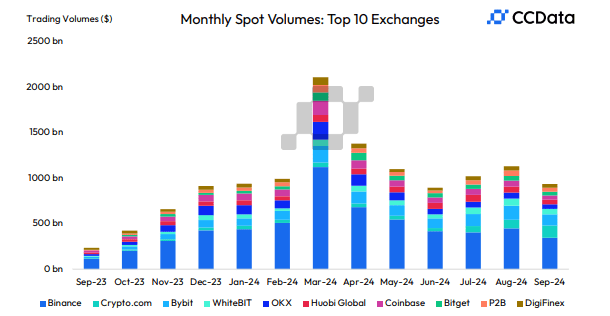

Monthly spot trading volumes for top 10 exchanges (Source: CC data)

Spot trading volumes fell 17.2% to $1.27 trillion, hitting the lowest level since June. Similarly, derivatives trading volumes in centralized exchanges decreased by 16.9%, reaching 3.07 trillion dollars. Despite the slowdown, market analysts remain optimistic that this lull in activity can be reversed in the coming months.

Potential catalysts such as increased liquidity from a possible US Federal Reserve. interest rate cuts and the next USA presidential election could stimulate commercial activity. The fourth quarter has historically been the strongest in the cryptocurrency sector, with the highest quarterly volumes recorded in six of the last ten years.

Among centralized exchanges, binance experienced the steepest decline as its spot trading volume fell 22.9% to $344 billion. This was its lowest monthly spot trading volume since November 2023. This drop also reduced Binance’s spot market share to 27%, the lowest level since January 2021.

In the derivatives market, Binance saw a 21% drop in trading volume, reaching $1.25 trillion, the lowest level since October 2023. Binance now owns 40.7% of the derivatives market, which is the lowest share since September 2020. Its combined market share in both spot and derivatives fell to 36.6%.

Combined CEX spot and derivatives market share by September 2024 (Source: CC data)

On the other hand, Crypto.com saw impressive growth despite the overall market crash. The exchange’s spot and derivatives volumes increased by 40.2% and 42.8%, respectively, reaching all-time highs of $134 billion and $149 billion. This growth boosted Crypto.com’s combined market share to 6.48% in September.

Despite the overall decline in trading volumes, open interest increased by 32.1% to $52.4 billion in September. This increase followed the Federal Reserve’s decision to cut interest rates by 50 basis points. Which fueled renewed optimism among traders.

Centralization and overvaluation threaten the stability of cryptocurrencies

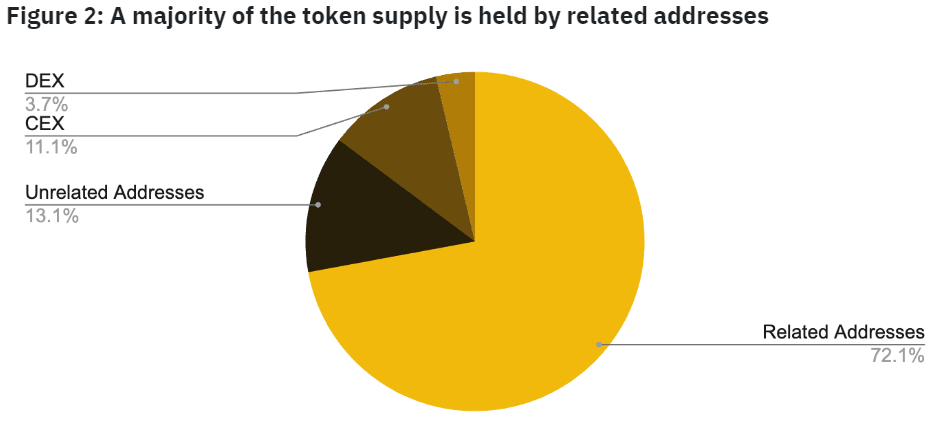

According to a report According to Binance, the cryptocurrency market faces serious risks due to overvaluation and centralization of token ownership. The report warned that if these issues are not addressed and fixed, they could undermine the long-term stability and integrity of the crypto industry.

The Binance report specifically referred to inflated valuations, especially in new thrown chipsas a major concern. These high valuations can create bubbles That could lead to poor performance due to a mismatch between supply and demand.

Venture capital funds that once invested aggressively in the cryptocurrency market are beginning to slow their rollout and are shifting toward sectors with more stable valuations. The report also indicated that as more tokens with low circulating supplies enter the market, the supply of tokens available on the secondary market will greatly increase, which could hurt the performance of many tokens.

In addition to concerns about overvaluation, Binance also pointed out the risks posed by the centralization of token ownership in many crypto projects. The concentration of tokens in the hands of a few large holders could lead to governance problems, market manipulationor sudden liquidations that destabilize the market.

Supply of tokens held by related addresses (Source: Binance Research)

Transparency is another critical issue raised in the report. Binance maintains that a lack of transparency in treasury management can erode trust and damage the long-term sustainability of a project. Companies like Coinbase are introducing proof of reserves, which helps mitigate at least some of the risks highlighted in the Binance report.

Kraken launches derivatives platform in Bermuda

Although exchange volumes are falling, that does not stop these platforms from expanding. Kraken recently launched a derivatives trading platform in Bermuda after receiving a license from the Bermuda Monetary Authority (BMA).

This move makes Kraken the latest crypto exchange to set up operations on the island. Bermuda is becoming an increasingly attractive place for regulate crypto activitiesand the Kraken license marks a major expansion in the region.

The BMA granted Kraken, which operates under the legal name Payward Digital Solutions, a Class F digital business license on July 30. This license allows Kraken to provide a variety of services, including wallet services, operate a digital asset derivatives exchange, and offer digital asset lending and repurchase transactions. Alexia Theodorou of Kraken Derivatives confirmed the license.

Kraken’s new platform offers more than 200 fixed-maturity and perpetual futures contracts, with collateral options in fiat currencies and more than 30 cryptocurrencies. Chief Operating Officer Shannon Kurtas shared that the launch is prompt as derivatives now account for the majority of cryptocurrency trading volumes.

Bermuda’s pro-crypto stance has made it a very attractive destination for crypto companies. Since 2018, when the Bermuda Digital Asset Business Act was passed, the island has attracted investment from major players such as Binance, which established a global compliance base there. The Bermuda Stock Exchange was also the first to host a Bitcoin Exchange Traded Fund in 2020. Coinbase International and Hong Kong-based HashKey Group also launched operations in Bermuda.

Coinbase demands communications from the CFTC

Trading volumes may not be the only challenge for some exchanges. In fact, Coinbase is still clashing with the SEC. Coinbase recently asked a federal court to force the Commodity Futures Trading Commission (CFTC) to provide communications with the issuers of 12 cryptocurrencies that the SEC says are not registered values.

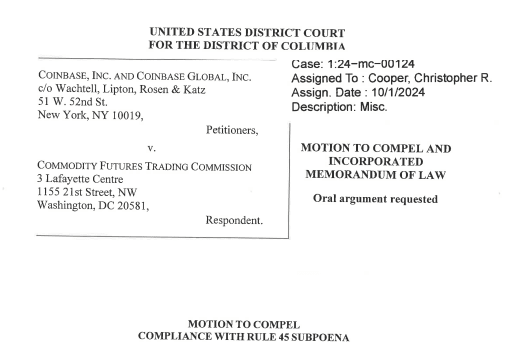

Coinbase Motion to Compel (Source: court listener)

The exchange wants these documents to help you in your defense against a SEC Lawsuit which was filed in June 2023. The regulator accused Coinbase of operating as an illegal broker, stock exchange, and clearing agency.

Coinbase claims the CFTC ignored its subpoenas and failed to seek or provide requested information, despite a federal judge. order the SEC to produce similar materials. The exchange also argues that the CFTC’s communications with cryptocurrency issuers could clarify the regulatory status of the tokens in question and are essential to Coinbase’s defense.

The CFTC previously rejected Coinbase’s requests due to issues of excessive breadth, burden and privilege, although it stated that it is willing to re-evaluate a narrow subpoena. Coinbase disputes the CFTC’s claims and insists that no privilege should apply to these communications with outside parties.

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.