The third quarter of 2024 saw an increase in stablecoin usage and adoption, according to Coinbase’s Q4 Crypto Markets Guide report with Glassnode.

Stablecoins hit an all-time high market capitalization of nearly $170 billion in the third quarter of 2024, according to the report. This growth occurred alongside the implementation of new European Union policies. Markets in the regulation of Cryptoassetswhich introduced clearer rules for stablecoin operations.

Stablecoins have become a key tool for users looking for faster, cheaper and safer transactions. Its usefulness in payment systems, including remittances and cross-border transfers, has continued to expand.

Recently, Antonio Pompliano argument that technological innovations outside of cryptocurrencies could lead to a new era in which stablecoins become the primary means of transaction in a machine-driven economy. This increased adoption reflects the growing role of stablecoins in cryptocurrency trading and real-world financial systems.

According to the report, stablecoin volumes have reached nearly $20 trillion year-to-date in the third quarter, indicating their growing role in the global economy.

Stablecoin and Bitcoin Mastery

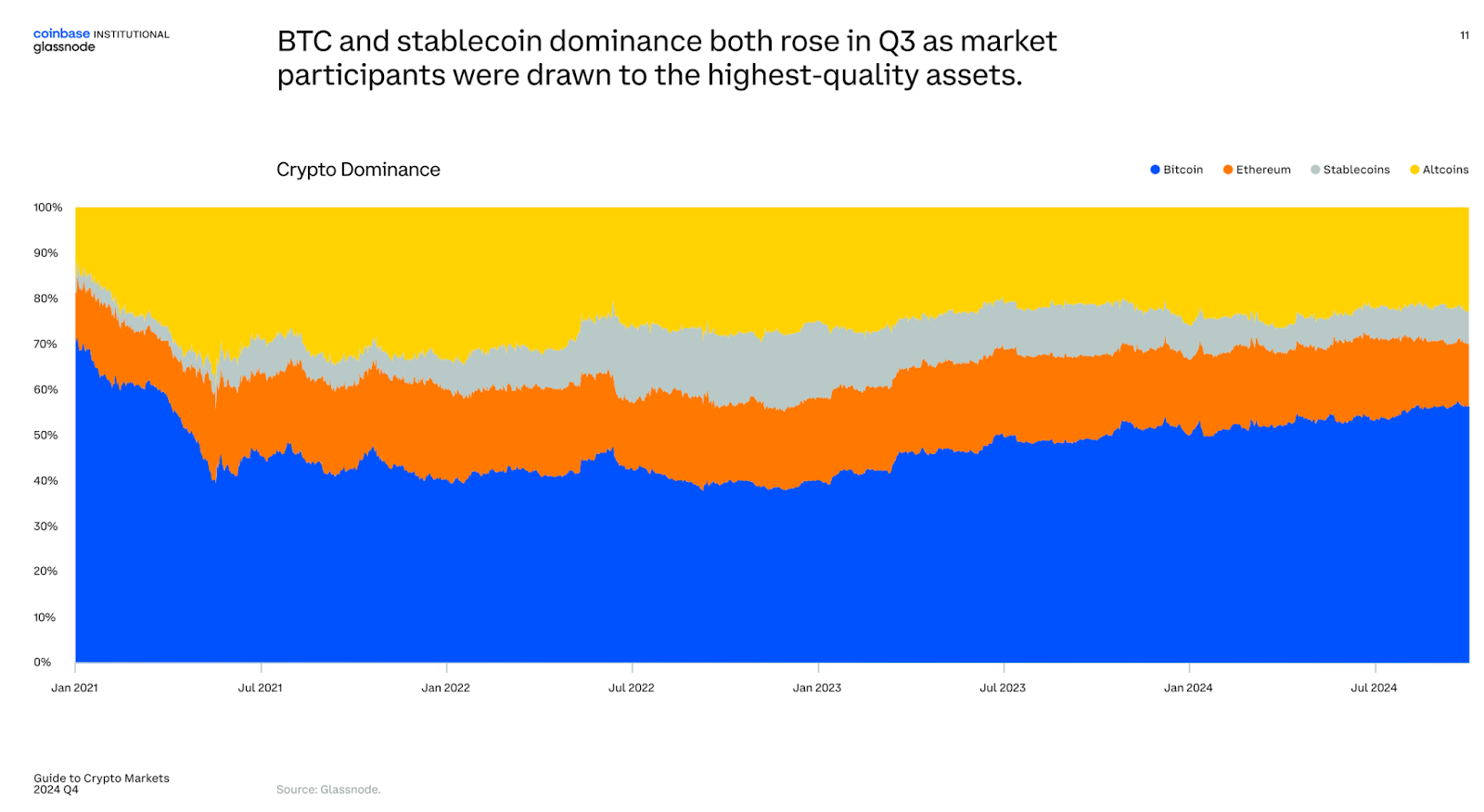

Stablecoin dominance also increased in the third quarter along with Bitcoin (btc), with cryptocurrency investors gravitating towards what they consider to be the highest quality digital assets.

The current BTC cycle closely follows the 2015-2018 and 2018-2022 cycles, which ended with returns of nearly 2000% and 600%, according to the report.

What is MiCA?

Markets in the regulation of cryptoassets It is a comprehensive framework enacted by the European Union in June 2023 to regulate the crypto industry in its 27 member countries. A transition period of 12 to 18 months begins to implement regulations on the fight against money laundering, the fight against the financing of terrorism and the custody of digital assets, among others.

MiCA’s impact on stablecoins remains to be seen, but Tether (USDT) CEO Paolo Ardoino expressed concern that MiCA’s 60% cash reserve requirement for stablecoins could create systemic risks for European banks. He argued that such regulations could exacerbate liquidity problems during large-scale redemptions, which could lead to bank failures.

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.