Analysts are divided on Bitcoin’s price outlook, with some predicting an eventual decline before further gains, while others view the growing open interest in Bitcoin as a more bullish sign. Meanwhile, Italy is considering a Bitcoin capital gains tax increase from 26% to 42% as part of its 2025 budget plan.

Stacked introduces Bitcoin and gold ETF

Stacked, also known as STKD, introduced a new exchange traded fund (ETF) that provides leveraged exposure to both Bitcoin (BTC) and gold. This measure was taken as investors increasingly focus on assets that are considered protection against inflation and currency debasement ahead of the upcoming US presidential election in November.

The STKD Bitcoin & Gold ETF (BTGD) will offer investors the opportunity to invest in two scarce assets, Bitcoin and gold, and its primary goal is to help protect against future inflation. For every dollar invested in the fund, it provides $1 of exposure to BTC and $1 to a gold portfolio through a combination of ETFs and futures linked to the prices of these assets.

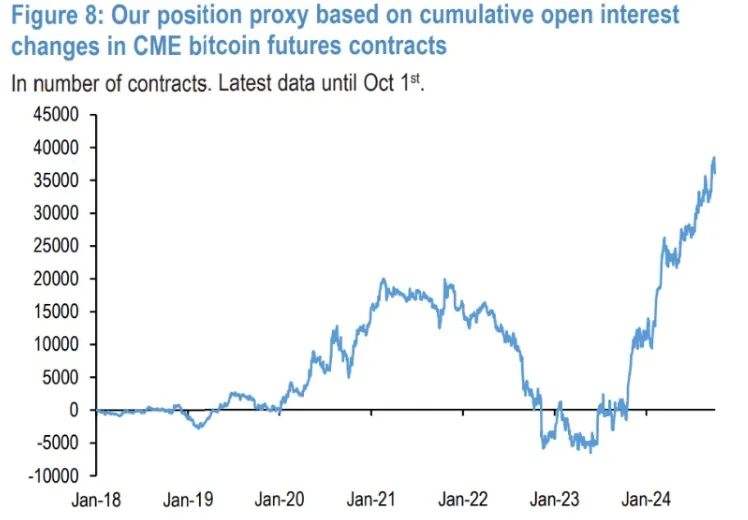

(Source: JP Morgan)

Futures contracts They are standardized agreements to buy or sell an asset at a future date and are a central part of the ETF structure. According to JPMorgan, geopolitical tensions and the upcoming US elections are very likely to drive demand for both Bitcoin and gold as investors prepare for a possible “catastrophic scenario.” The bank’s report revealed that the increase geopolitical uncertainty Starting in 2022, concerns about long-term inflation and persistently high government deficits are fueling the so-called “debasement trade,” which traditionally favors gold and, more recently, Bitcoin.

STKD addressed the ongoing debate between Bitcoin and gold, and shared that focusing on the two as competitive assets completely misses the big picture. Instead, both can play important roles for investors looking for a combination of capital appreciation and portfolio coverage.

This launch also adds to a growing number of cryptocurrency-related ETFs being proposed ahead of the US elections. Canary Capital plans to launch an XRP and Litecoin ETF, and Bitwise is also exploring a XRP ETF.

Leveraged ETFs also gained some momentum, with MicroStrategy Related ETFs crossing $400 million in net assets. However, leveraged ETFs carry higher risks and generally underperform due to the costs associated with daily rebalancing to maintain their leveraged targets.

Analysts are divided on Bitcoin’s path

Bitcoin’s recent move past the $68,000 mark fueled optimism among traders, and some believe it could lead to a new test of its all-time high. However, not all analysts are completely convinced that this rally will be as simple as most people think.

Shubh Varma, CEO of Hyblock Capital, said in an October 16 report reportthat a final decline may occur before the market rises again. He pointed to Binance data showing that less than 40% of retail traders hold long positions, which could indicate a possible reversal. Varma also warned that if a large number of retail traders start going long, it could be a bearish signal.

Varma went on to note that Bitcoin’s open interest (OI) reached its all-time resistance level, which could indicate the possibility of a corrective move to eliminate long positions. On October 16, Bitcoin OI hit a new year-to-date high of $39.36 billion, surpassing the previous peak of $38.8 billion set in April, according to CoinGlass data. A price drop followed by a drop in OI could confirm this correction.

BTC Futures Open Interest Exchange (Source: glass coin)

Despite this, some analysts still believe that the rise in open interest could actually indicate an uptrend. Crypto Investor Lark Davis He argued that the increase in OI suggests an influx of attention and liquidity entering the crypto market, which often precedes positive price movements.

Markus Thielen, head of research at 10x Research, suggested on August 7 that a Bitcoin drop into the low $40,000 range could present an ideal buying opportunity for those looking to time the next bull market. Although some analysts are optimistic, the future Bitcoin address remains very uncertain.

Bitcoin is “in the window”

Veteran commodities trader Peter L. Brandt recently took to social media to share an important message with the global crypto community about Bitcoin. Brandt often comments on various cryptocurrencies, including Bitcoin, Ethereumand solariumbut he recently reiterated his belief in the potential of Bitcoin. Despite his preference for Bitcoin, Brandt also traded Ethereum when he saw profitable opportunities, although it is not his preferred asset.

In his latest post, Brandt revised a Bitcoin chart he had originally shared on October 15, stating that the price is “in the window.” He explained that Bitcoin’s current position could lead to a breakout, where the asset “comes out the window,” or a crash, with “the window closing on your head,” implying a potential price drop.

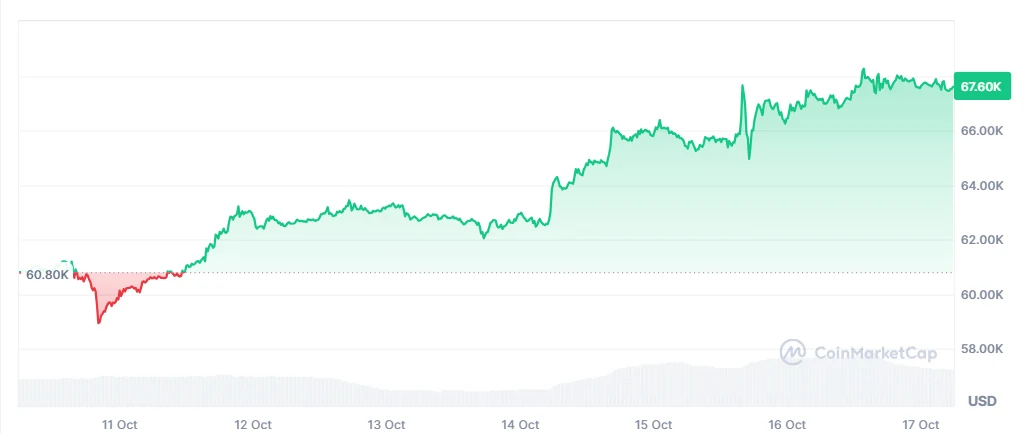

During the last 24 hours, The price of bitcoin managed a small price increase of 0.74% to trade at $67,584.60 at the time of publication, according to CoinMarketCap. Since Sunday, Bitcoin is up more than 10%.

Bitcoin 7d price chart (Source: CoinMarketCap)

Italian government proposes tax increase on Bitcoin

The Italian government studies increasing capital gains tax in Investments in bitcoins from 26% to 42%, according to the vice minister of Economy, Maurizio Leo. He speak at a press conference on October 16, and explained that this proposal is part of the new budget bill, which has already been approved by the Council of Ministers. The increase in withholding tax on Bitcoin capital gains is one of the most important changes included in the bill.

Additionally, Italy plans to eliminate the minimum income threshold for its Digital services tax (DST), which currently applies to companies with at least €750 million of global revenue and €5.5 million of digital services revenue in Italy. By removing these thresholds, the government wants to expand the scope of the tax to more companies that operate digital services in the country.

Maurizio Leo speaking at the press conference (Source: YouTube)

The government also approved a budget of 30 billion euros by 2025, which will be partly financed by a tax on banks and insurers. This budget is still pending parliamentary approval and is expected to raise €3.5 billion to improve public services and help vulnerable citizens. Prime Minister Giorgia Meloni said there will be no new taxes on individuals and that additional revenue will go to healthcare and essential services.

Italy previously increase the tax on capital gains on cryptocurrency trading of more than 2,000 euros at 26% as part of the 2023 budget.

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.