Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of the crypto.news editorial team.

It’s been an “exceptionally eventful month” for Bitcoin (Bitcoin). BTC whale transactions reached a four-month high as the market “purged” short-term holders. Speculators’ unrealized losses hit Crypto assets worth millions of US dollarsThese removals reiterate the urgent need to encourage long-term adoption.

Meanwhile, investors are “buying the dip” and Bitcoin Spot ETF recorded some of the higher single-day tickets.

Thus, short-term bleeding and apparent chaos coexist with general optimism and demand. And as Blockworks’ David Canellis recently said: wrote:

“…Perhaps we are finally ready to leave behind, forever, the worst dramas in the history of cryptocurrencies.“

Beyond the typical view of numbers going up (or down), Bitcoin is experiencing a renaissance, primarily from an asset perspective: it is moving beyond the “digital gold” image and expanding on the utility front.

BTC is finally a “productive asset” thanks to the evolution of Bitcoin DeFi, or BTCfi. Additionally, layer 2s like Stacks bring programmability to the world’s most decentralized and secure blockchain. Bitcoin is becoming the home of new-age decentralized applications – Stacks is dominating this trillion-dollar blockchain. chanceAnd there is a lesson here: be consistent and start from the beginning.

At first slowly, then suddenly.

Bitcoin and the economy it underpins are based on the principle of low time preference. It’s a feature, not a bug. Rome wasn’t built in a day. But it’s easy to lose sight of this reality amid all the noise around cryptocurrencies.

BTCfi started to receive the hype and attention it deserves after Ordinals and BRC20 Released In 2023, the first practical proofs were released that Bitcoin can be much more than a store of value. However, the primitives for a fully functional BTCfi have been in production for much longer. Stacks was launched in 2013, for example, and created Clarity in 2021, the programming language for Bitcoin-compatible smart contracts.

More importantly, they developed the transfer test (PoX) consensus mechanism that allows L2 chains to inherit the security of Bitcoin without additional energy expenditure.

These early innovations laid the groundwork for the now-thriving Bitcoin L2 ecosystem, which currently has more than 2 billion dollars in TVL. However, the need to scale Bitcoin on the second layer became truly apparent only when Runes shipped the Network rates skyrocket after halving.

That’s the nature of lasting technological change: it happens slowly at first, then suddenly. And when it does, the visionaries who build real solutions without saying thank you (before anyone else even cares) succeed.

Does it work or not? That is the question

Despite its merits, getting there early is not the end goal. The crypto community has heard enough promises over the years. They want real results now. Ultimately, it all comes down to the question of impact, and that’s great.

Most existing Bitcoin L2s fail to solve the problem Impossible trinityAt best, they are loosely tied to Bitcoin’s L1, or at worst, they are highly centralized. Only a few projects like Stacks have made the right trade-offs, even if it means angering some tops. Commitment to Bitcoin’s core ethos separates L2s that are lodging dApps and those that rely solely on marketing gimmicks or speculative price action.

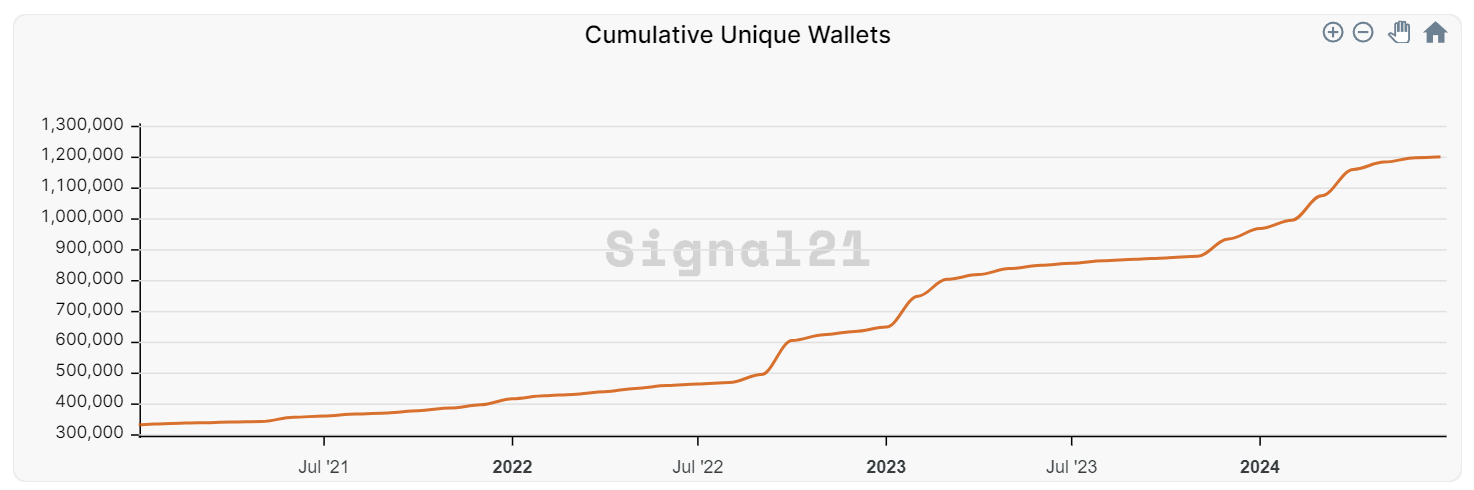

Stacks took a big step forward in this direction with its performance improvements. Nakamoto’s release with a trustless two-way BTC pegging mechanism, also known as sBTCThe impact of this move is reflected in the growing number of monthly active Stacks accounts, which reached an all-time high of more than 1.2 million in the second quarter of 2024.

In addition, Stacks currently has a TVL of on $68 million, as most of the major Bitcoin decentralized applications are being developed on this platform. Slowly but steadily, they are helping to improve Bitcoin’s TVL/market cap ratio, which was a mere 0.2% in May 2024, compared to 17% for Ethereum.

Along with the evolution of Bitcoin dApps, major VCs and investors are backing the production of AI-powered applications. interoperability and bridging solutions. These tools will further improve Bitcoin’s liquidity situation. AI agents, for example, will enable users to seamlessly move funds into the Bitcoin ecosystem even without complex technical knowledge. This means they can better integrate Bitcoin decentralized applications into their workflows while also benefiting from other chains.

It will no longer be a zero-sum game, which is great for holistic growth. Given these developments, the coming “defi summer” in Bitcoin is a tangible, almost imminent reality. It is no longer an optimist’s fantasy.

BTCfi has found its tipping drivers and may soon become at least as big as DeFi on Ethereum. However, ideally it would be much bigger thanks to Bitcoin. on 54% market dominance.

The biggest appeal of BTCfi’s innovations is that they primarily improve and expand the underlying native asset. It is not a zero-sum game where projects extract maximum value at the expense of end-users and developers.

Rather, it is about a collective effort to ensure grassroots empowerment and financial freedom. Bitcoin-based decentralized applications are the means to a greater end. They represent a philosophy where technology becomes the driver of individual sovereignty and freedom, not just an enabler of short-term selfish gains. It is about bringing about meaningful change in the lives of the next billion cryptocurrency users and beyond. That will lead to a better world, financially and otherwise.

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.