For years, Bitcoin enthusiasts have been waiting for a significant shift in value due to the involvement of institutional investors. The concept was simple: as corporations and large financial entities invested in Bitcoin, the market would experience explosive growth and a sustained period of price increases. However, the actual outcome has been more complex. Although institutions have indeed invested substantial capital in Bitcoin, the anticipated “supercycle” has not played out as predicted.

Institutional accumulation

Institutional participation in Bitcoin has increased significantly in recent years, marked by substantial purchases by big companies and the introduction of Bitcoin exchange-traded funds (ETFs) earlier this year.

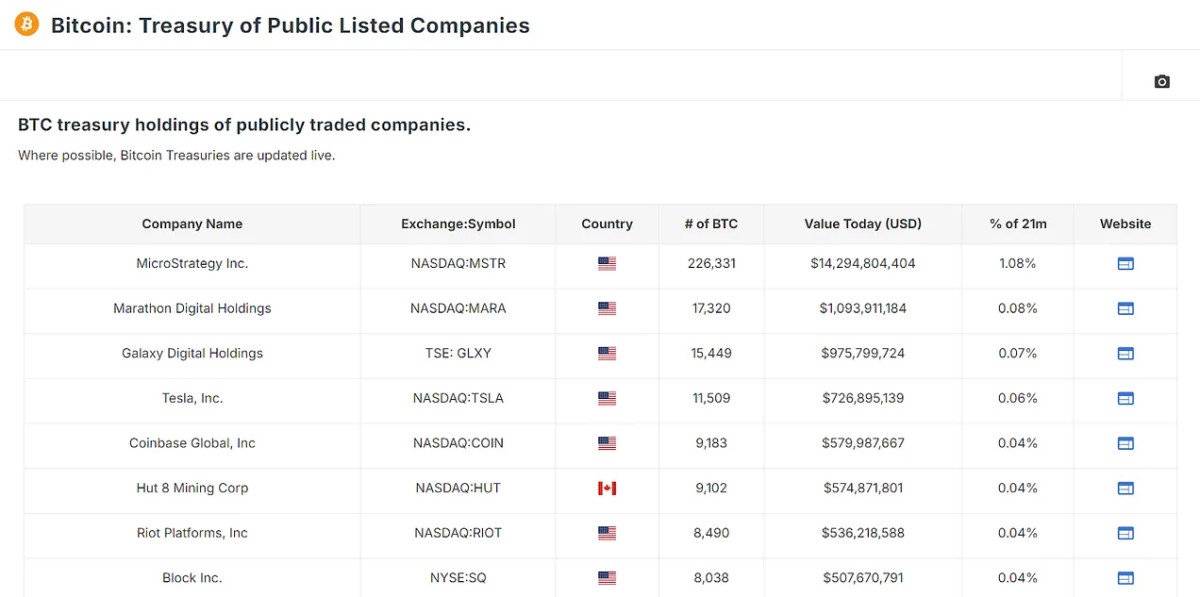

Leading this movement is MicroStrategy, which alone holds over 1% of the total Bitcoin supply. After MicroStrategy, other prominent players include Marathon Digital, Galaxy Digital, and even Tesla, with significant stakes also found in Canadian firms such as Hut 8 and Hive, as well as international companies such as Nexon in Japan and Phoenix Digital Assets in the UK; all of which can be tracked through the new Treasury data Charts available on site.

In total, these companies own more than 340,000 bitcoins. However, the real paradigm shift has been the introduction of bitcoin ETFs. Since their inception, these financial instruments have attracted billions of dollars in investments, resulting in the accumulation of more than 91,000 bitcoins in just a few months. Altogether, private companies and ETFs control around 1.24 million bitcoins, which represents approximately 6.29% of all bitcoins in circulation.

A look at Bitcoin’s recent price movements

To understand the potential future impact of institutional investment, we can look at the recent price movements of Bitcoin since the approval of Bitcoin ETFs in January. At the time, Bitcoin was trading at around $46,000. Although the price dropped shortly afterward — a classic “buy the rumor, sell the news” scenario — the market quickly recovered and within two months, the price of Bitcoin had increased by approximately 60%.

This increase correlates with the accumulation of Bitcoin by institutional investors via ETFs. If this pattern continues and institutions keep buying at the current pace or at a higher pace, we could witness a sustained bullish momentum in Bitcoin prices. The key factor here is the assumption that these institutional players are long-term holders, and are unlikely to sell their assets in the near future. This continued accumulation would reduce the liquid supply of Bitcoin, requiring less capital inflow to drive prices further.

The multiplier effect of money: amplifying the impact

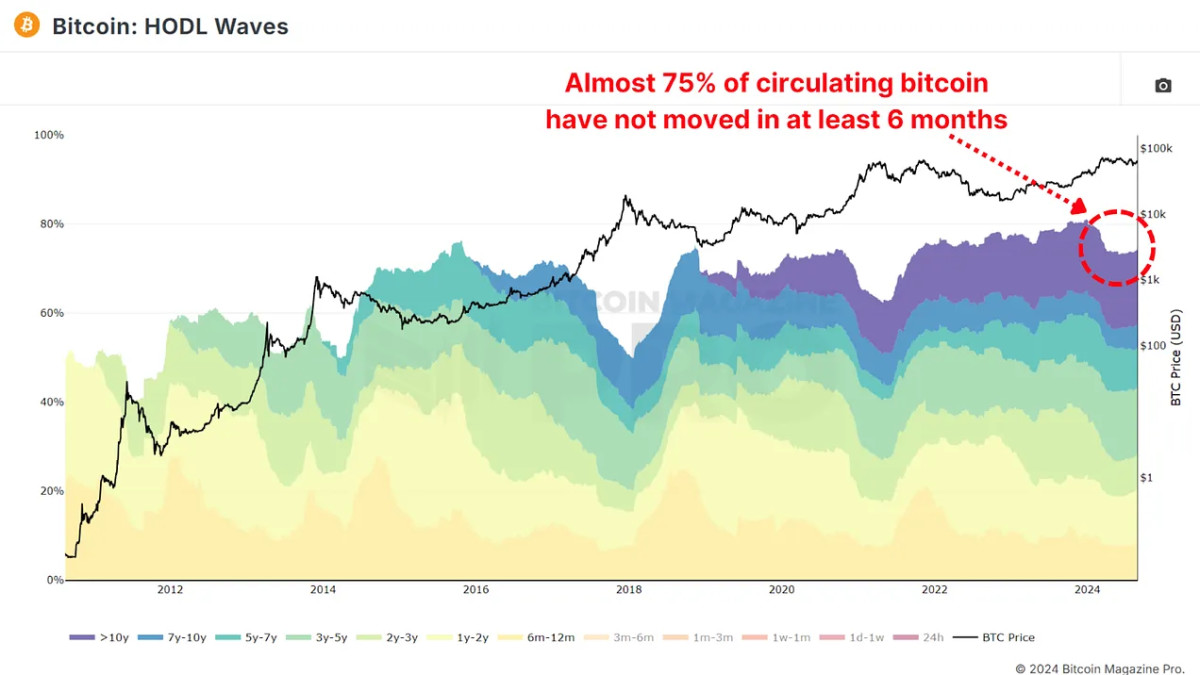

The accumulation of assets by institutional players is significant. Its potential impact on the market is even more profound when one considers the money multiplier effect. The principle is simple: when a large portion of the supply of an asset is withdrawn from active circulation, such as the nearly 75% of the supply that has not moved in at least six months, as described in the HODL wavesThe price of the remaining circulating supply may be more volatile. Every dollar invested has a magnified impact on the overall market capitalization.

In the case of Bitcoin, where approximately 25% of its supply is liquid and actively traded, the money multiplier effect can be particularly potent. If we assume that this illiquidity results in a $1 increase in market cap of $4 (money multiplier times 4), institutional ownership of 6.29% of all bitcoins could effectively influence around 25% of the circulating supply.

If institutions were to start dumping their holdings, the market would likely experience a significant drop. Especially since this would likely trigger retail holders to start dumping their bitcoins as well. Conversely, if these institutions continue to buy, the price of BTC could rise dramatically, particularly if they maintain their positions as long-term holders. This dynamic underscores the double-edged nature of institutional involvement in Bitcoin, as it slowly and suddenly possesses a greater influence on the asset.

Conclusion

Institutional investment in Bitcoin has both positive and negative aspects. It brings legitimacy and capital that could drive Bitcoin prices to new heights, especially if these entities commit to the long term. However, the concentration of Bitcoin in the hands of a few institutions could lead to increased volatility and significant downside risk if these actors decide to exit their positions.

For a more in-depth look at this topic, check out a recent YouTube video here:

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.