The notice of appeal was filed because there is growing institutional interest in XRP. Meanwhile, SEC enforcement chief Gurbir Grewal announced that he will resign, fueling speculation that the agency could change its approach to cryptocurrency regulation. Additionally, AT&T faces a new lawsuit from crypto investor Michael Terpin over a SIM swapping attack in 2020, while Kalshi won a legal battle against the CFTC allowing him to offer election betting contracts.

SEC appeals Ripple lawsuit ruling

The United States Securities and Exchange Commission (SEC) has filed a notice of appeal in its ongoing process. lawsuit against ripple on October 2, 2024. The SEC seeks to overturn an earlier ruling issued by Judge Analisa Torres.

This decision was widely expected by legal experts, since the original ruling in 2023 It was seen as a pivotal moment for Ripple Labs and the crypto industry. In that ruling, Judge Torres concluded that Ripple’s XRP token did not qualify as a security when sold on secondary markets, as it did not meet all of the conditions of the howey test. The SEC uses the Howey test to define investment contracts. As a result, secondary sales of XRP were no longer considered sales of unregistered securities.

However, Torres also noted that the first sales of XRP by Ripple’s founders to institutional investors were actually sales of securities, due to the way those transactions were made. Despite this, Ripple and the crypto community celebrated the 2023 ruling as a victory on the regulator.

Interest in XRP appears to be growing among institutional investors despite the SEC’s legal battle against Ripple. Bitwise Asset Management Company applied for an XRP ETF trust in Delaware on September 30, 2024. Although this filing is an important step towards the creation of an XRP trust, it is important to remember that the application was not made to the SEC.

Considering the recent legal developments surrounding Ripple and the SEC appeal, it is quite possible that any future approval of an XRP trust will face some delays.

Gurbir Grewal resigns

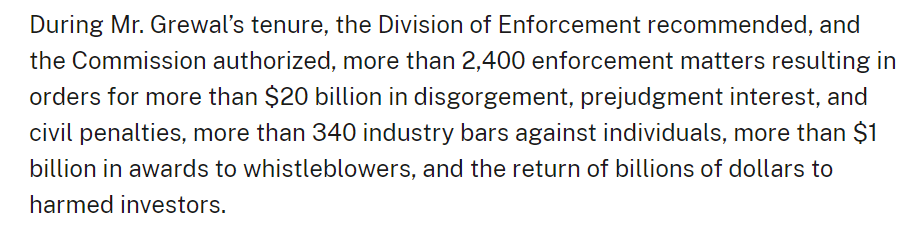

Gurbir Grewal, the US SEC’s chief enforcement officer, lower on October 11 after a term plagued by aggressive actions against the crypto industry. Sanjay Wadhwa, deputy director of enforcement at the SEC, will serve as acting director while a permanent replacement is selected. Grewal’s three years of leadership resulted in more than 100 compliance actions targeting non-compliance in the cryptocurrency sector, including cases against some of the world’s largest cryptocurrency trading platforms.

Part of the SEC press release (Source: SECOND)

His sudden resignation has affected rumors in the crypto community, with some people speculating that the SEC may be preparing to take a less strict approach towards crypto regulation. This change came as political pressure mounts on the SEC ahead of the November US presidential election. choice.

In September, Democratic candidate Kamala Harris openly expressed his support for the United States to become a leader in the cryptocurrency industry. Meanwhile, Republican candidate Donald Trump also pledged to remove the SEC chairman. Gary Gensler if he wins the elections.

During a House Financial Services Committee hearing in September, Gensler faced many criticism of legislators and members of the SEC for their handling of crypto regulation. The growing resistance of the cryptocurrency industry is also very evident, with companies like Ripple and Coinbase backing Fairshake, a political action committee that has raised more than $169 million for the 2024 election cycle.

Jake Chervinsky, chief legal officer at Variant Fund, described Grewal’s departure as a sign that the SEC faces major setbacks in court. In his farewell statement, Grewal shared that he is very proud of his work and also touched on certain achievements such as recalibrating sanctions, addressing emerging risks, and holding market participants accountable. His departure marks the end of a 21-year career in the SEC.

AT&T goes back to court

Ripple is not the only company that runs afoul of the law. AT&T will return to court after a summary judgment in its favor was partially overturned on appeal. The case dates back to 2020, when cryptocurrency investor Michael Terpin sued Ellis Pinsky, who was a high school student at the time, for stealing $24 million in cryptocurrency through a SIM swap attack. Pinsky, along with an accomplice, bribed an AT&T employee to transfer Terpin’s SIM card information, allowing them to bypass the two-factor authentication protecting one of Terpin’s phones. crypto wallets.

Terpin’s legal battle with AT&T centers on the telecommunications company’s obligation to protect your SIM card information under Section 222 of the Federal Communications Act. While most of Terpin’s statements were dismissed by the Ninth Circuit Court of Appeals, his claim under this section was allowed to proceed.

The court did not reinstate Terpin’s fraud claims or his demand for $216 million in punitive damages. Terpin is now seeking a total of at least $45 million from AT&T, which includes the original $24 million in stolen funds, interest and attorney fees.

The complex case has involved several dramatic twists. One of them was the fact that Terpin successfully located Pinsky, who returned 2 million dollars of the stolen funds. In May 2020, after Pinsky turned 18, Terpin sued him for $71.4 million on extortion charges.

Pinsky has since agreed to testify in the case against AT&T. Terpin also sued Pinsky’s accomplice Nicholas Truglia for $75.8 million in 2019, and won the case. The story of Pinsky and Truglia’s online meeting and subsequent robbery even appeared in a Rolling Stone Magazine Article in 2022.

Court gives green light to Kalshi’s election betting contracts

Prediction markets have also been under regulatory scrutiny, especially as the US presidential election approaches. However, a United States federal appeals court has ruled in favor of Kalshia derivatives exchange, which allows you to list event contracts linked to the US election results.

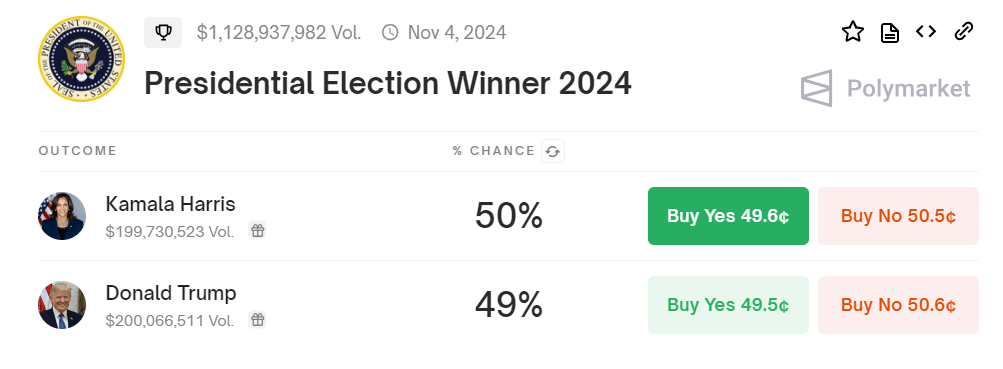

The ruling was issued on October 2 by the United States Court of Appeals for the District of Columbia Circuit and is a blow to the Commodity Futures Trading Commission (CFTC), which attempted to prevent Kalshi from offering these contracts before the US presidential election. The decision now opens the door to election prediction marketsincluding platforms like Polymarketto operate in the U.S. According to its website, there is already more than a billion dollars at stake in the outcome of the November elections at Polymarket.

Polymarket Presidential Election Winner Odds and Volume (Source: Polymarket)

Kalshi also previously won a legal battle against the CFTC in September, overturning a order that prohibited the listing of contracts for political events. The CFTC argued that these contracts were akin to illegal gambling activities and contrary to the public interest. In response, the CFTC appealed the decision and requested a stay to prevent kalshi from listing any event contracts until the appeal is resolved.

However, the court’s Oct. 2 ruling rejected the CFTC’s request because the agency failed to demonstrate that it or the public would suffer irreparable harm during the appeals process. The court stated that the case was not about whether Kalshi’s product was favorable but about the legality of the contracts under existing US financial regulations.

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.