TON, the native coin of blockchain network Toncoin, is under massive selling pressure. Despite maintaining its spot in the top 10, the recent drop has raised doubts and widened the cracks in an otherwise solid uptrend.

TON falls, liquidity provider sells

According CoinMarketCapTON is down nearly 18% over the past week of trading but has remained stable over the past day. However, the coin has held its own over the past six months. A look at TON’s daily chart shows that it is up nearly 200% and maintains an uptrend.

If the losses of August 24 are prolonged, TON could fall and retest the immediate support level marking the July lows around $4.8. Still, further losses could trigger panic selling among holders, fueling another wave of selling pressure. In turn, this will confirm the losses from the weekend.

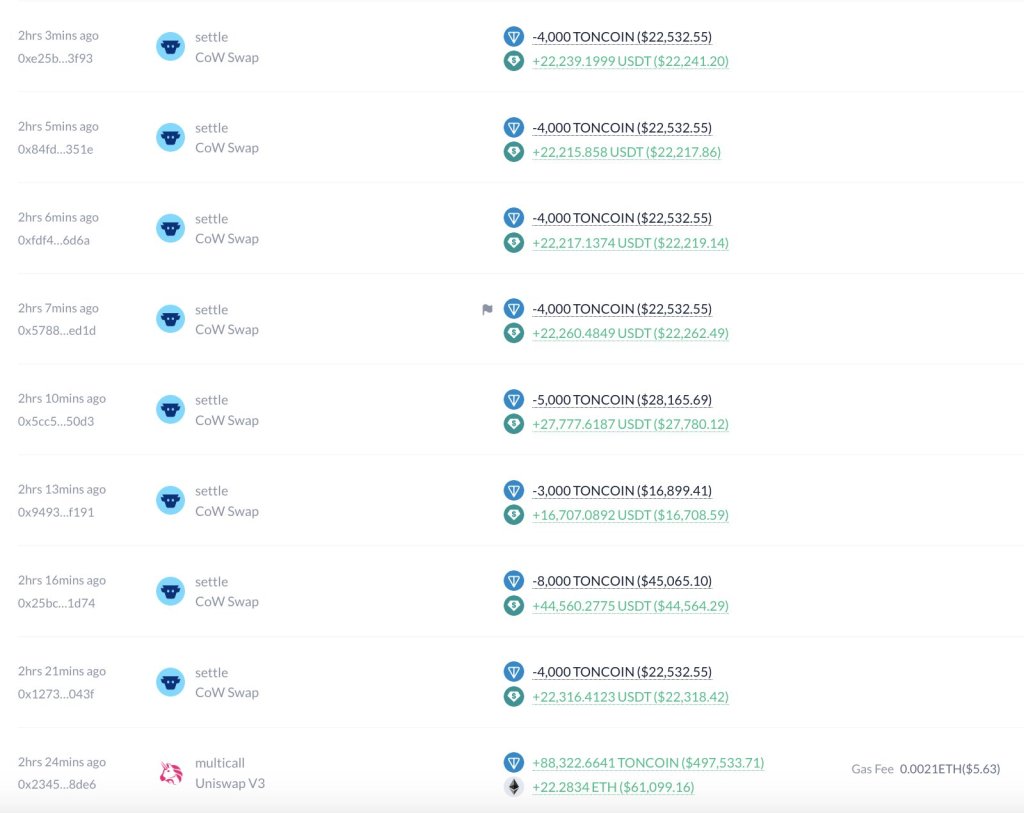

On August 26, Lookonchain analysts noted That large liquidity provider (LP) exited the market and sold over 350,000 TON worth $1.98 million. Interestingly, the LP decided to sell wholesale at $5.57.

Hours later, prices are in the green, with a slight downward trend, as can be seen on the daily chart. The situation could worsen in the next hours or days if other “small” holders follow this trend.

Typically, when large token holders, in this case the liquidity provider, decide to liquidate, a domino effect is created. Since these entities are supposed to be more informed than retail investors, their market outlook can be interpreted as bearish.

Therefore, following in their footsteps and locking in current prices could mean exiting when liquidity is high and profits are decent.

Telegram’s Pavel Durov arrested, what’s next for Toncoin?

For now, it remains to be seen whether TON holders will continue selling, following the liquidity provider’s path. What is clear, however, is that the selling pressure on August 24 could shape the short- to medium-term trend. It will be an especially turbulent time for TON holders if bears push and break below $4.8.

The trigger for this dump will be if Pavel Durov, the CEO of Telegram, is detained for a longer period. Over the weekend, Durov, whose messaging app is closely linked to the open-source network The Open Network, was detained for a longer period. arrested in Paris, France.

Durov’s arrest is rumored to be linked to Telegram, whose messages are encrypted. Authorities claim that the messaging app, led by Durov, did not take sufficient measures to moderate messages. They also claim that Telegram did not collaborate with law enforcement to exterminate suspected criminals.

In a statementTelegram said Durov “has nothing to hide.” The team also said the messaging app is committed to ensuring standard moderation practices and complying with EU laws.

Featured image from Wikimedia Commons, chart from TradingView

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.