Last week, altcoins took a hit, leading to a $40 billion drop in the global cryptocurrency market cap, which fell to $2.09 trillion. This week’s trio of top cryptocurrencies are worth keeping a close eye on in the coming days.

RARE posts a weekly gain of 223%

Super Rare (STRANGE), the native token of the NFT Marketwitnessed volatility last week.

The token started the week with a 34% increase before facing a three-day drop from August 12 to 14, falling 18%.

However, it rebounded on August 15, leading to a surge in social volume, according to a disclosure by LunarCrush.

Amid a resurgence of interest, RARE maintained its bullish trend, rising 127% in three days and closing the week with a gain of 223%.

The token’s RSI now stands at 91.14, indicating an overbought condition. This suggests a possible correction is in the offing. The CCI, at 374.45, also signals massive overbought levels, confirming these sentiments.

The latest surge has helped RARE to break above the 0.236 Fibonacci level as it currently looks to be holding its position above $0.3. If RARE holds the 0.236 Fibonacci support, it could continue to rise.

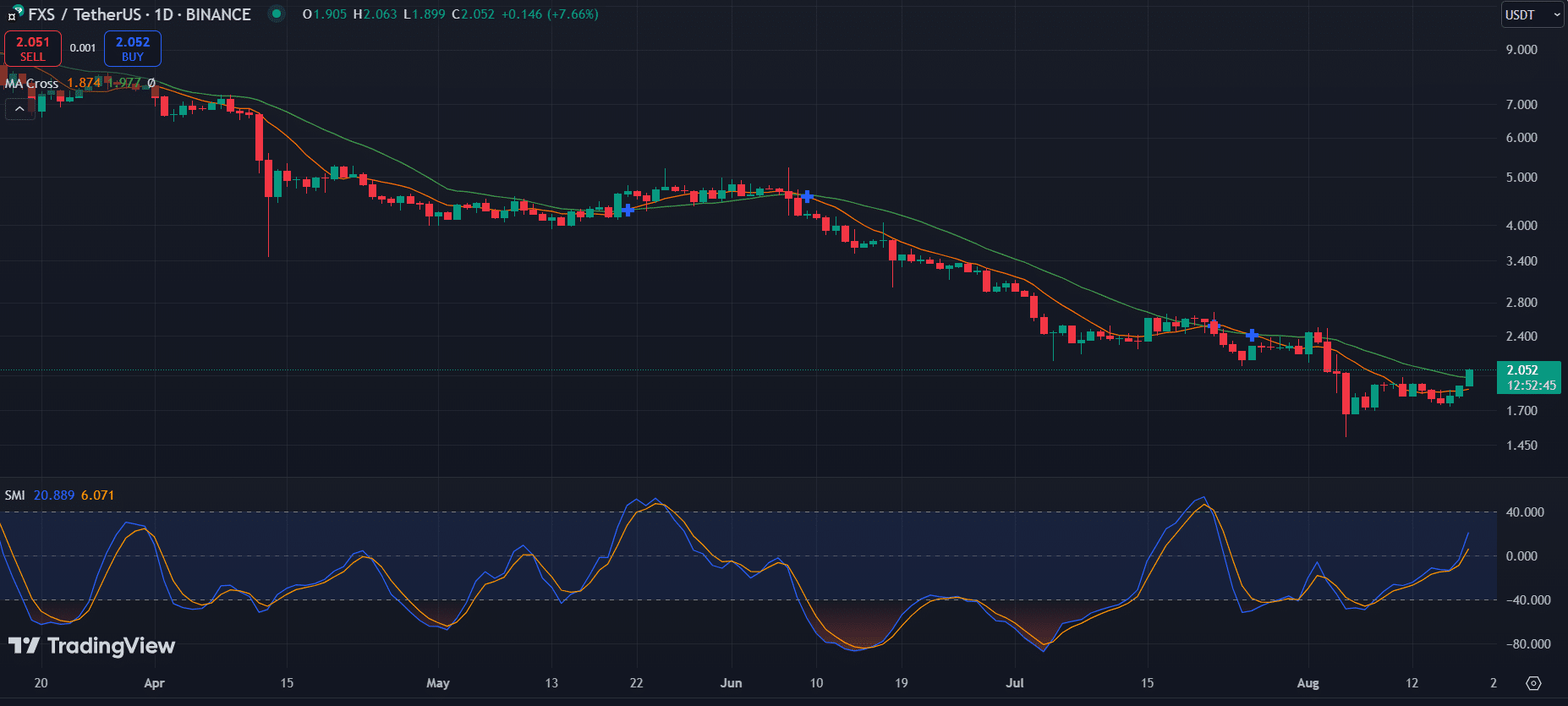

FXS syndrome maintains its resilience

Share Frax (FxS) showed limited volatility last week, closing at $1,906. This represented a meager drop of 0.67%. This lackluster move contrasted with the downtrend in the broader market, suggesting a hint of resilience on the part of the FXS.

However, Frax Share’s moving averages indicate bullish potential. The asset recently broke above the nine-day moving average (orange line) as its short-term momentum turned bullish.

Additionally, the nine-day moving average appears to be crossing above the 21-day moving average (green line). If this moving average crossover occurs, it could signal a bullish reversal on the horizon.

The Stochastic Momentum Index also supports this outlook. The SMI line (blue) has risen above the MA line (orange), indicating that bullish momentum is building. As both indicators align, FxS It could be about to go up, but it is essential to confirm this in the next few days.

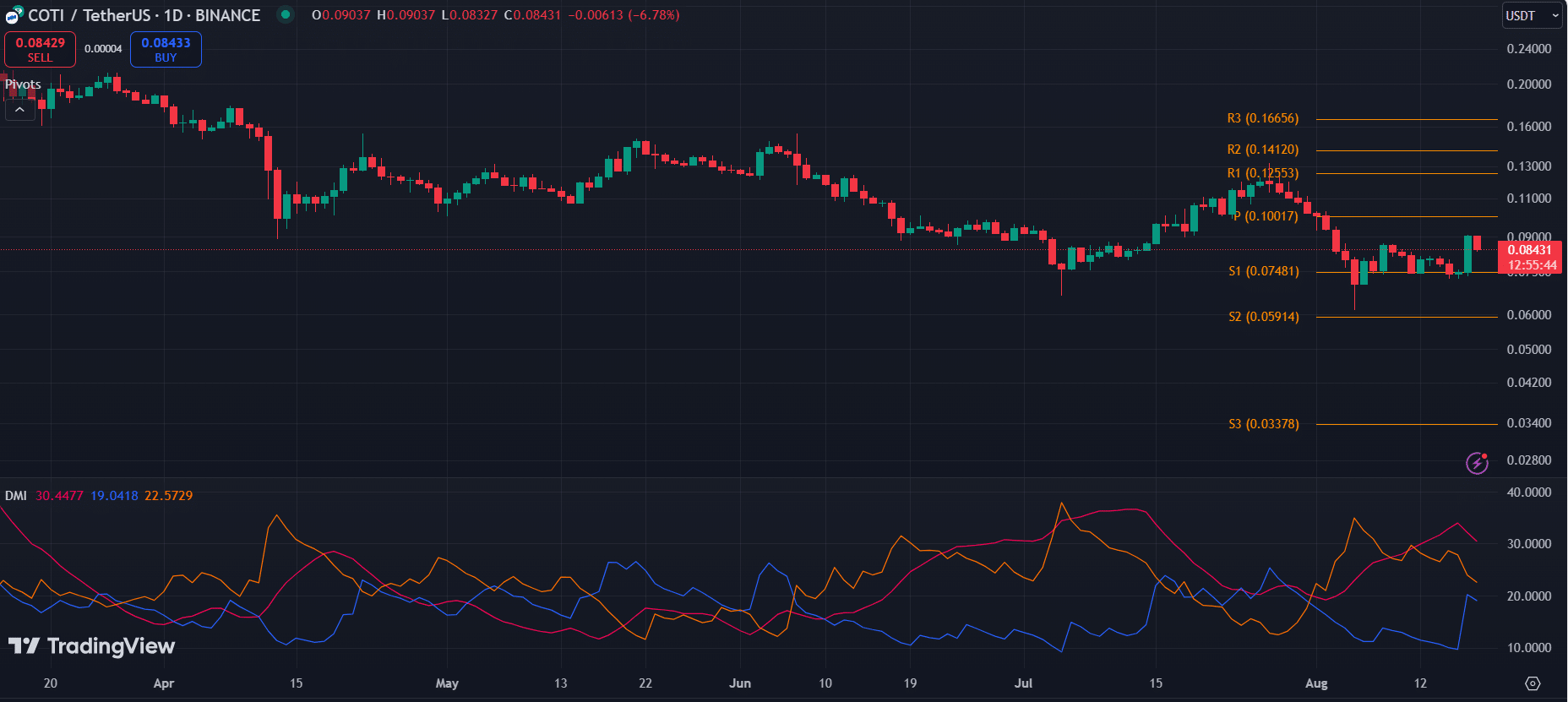

COTI faces mixed feelings

The COTI was bearish throughout last week, falling 14% between August 11 and 15. However, on Saturday it registered a 21% increase to close the week with a 10% increase.

The asset has now corrected as it faces selling pressure.

Daily pivot points show key resistances at $0.10017, $0.12553 and $0.14120. COTI’s immediate support lies at $0.07481, which represents S1.

A break below S1 could push prices towards S2 at $0.05914.

Meanwhile, the directional movement index indicates bearish momentum. The ADX (red line) is at 30.4, suggesting a strong trend, while the -DI (orange line) at 22.57 is above the +DI (blue line) at 19.04, confirming bearish pressure.

The ability of the COTI to stay above S1 is crucial. Failure to do so could trigger a further decline, while breaking above the pivot could offer an opportunity for a recovery.

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.