By Vince Golle and Andrew Langley

Next week’s U.S. inflation figures will reinforce the view that long-awaited interest rate cuts are coming soon, while a reading on consumer spending is expected to indicate the central bank has been successful in keeping the expansion intact.

Economists expect the personal consumption expenditures price index excluding food and energy — the Fed’s preferred measure of core inflation — to rise 0.2% in July for a second straight month. That would push the quarterly annualized rate of so-called core inflation down to 2.1%, just above the central bank’s 2% target.

Economists surveyed by Bloomberg also expect consumer spending, unadjusted for price changes, to rise 0.5%, the biggest gain in four months, in Friday’s report.

Speaking at the Jackson Hole symposium, Federal Reserve Chairman Jerome Powell acknowledged recent progress on inflation, saying he has gained confidence that it is on track to return to 2% and that “the time has come to tighten policy.”

Friday’s comment marked a key turning point in the Fed’s two-year battle against price pressures and underscored how the focus has shifted to risks in the labor market, the other part of the central bank’s dual mandate. Job growth has helped sustain consumer spending, a key to ensuring the economy expands.

On Thursday, the government will publish its first revision of second-quarter gross domestic product. Economists’ median projection sees an annualized growth rate of 2.8%, unchanged from the previous reading.

Other US data due next week include durable goods orders for July on Monday and separate consumer confidence indexes on Tuesday and Friday.

San Francisco Federal Reserve President Mary Daly, a voting member of the FOMC in 2024, will appear on Bloomberg Television on Monday. Another voting member, Atlanta Fed President Rafael Bostic, will speak about the economic outlook on Wednesday.

—Anna Wong, Stuart Paul, Eliza Winger, Estelle Ou.

Preliminary data suggested annualized quarterly growth of 2.2% — higher than the central bank’s forecast of 1.5% — reinforcing its efforts to engineer a soft landing while continuing to lower borrowing costs.

Investors will also be watching for the latest developments in resolving a Canadian rail dispute that has paralyzed North American supply chains.

Elsewhere, the eurozone will release August inflation less than two weeks before the European Central Bank decides on monetary policy, while China’s central bank will set the interest rate on its one-year loans. Interest rate decisions include Hungary and Israel.

Asia

The week begins with renewed focus on China’s new monetary framework, as the People’s Bank of China sets the interest rate on its one-year policy loans. Following a surprise cut in July, authorities are expected to keep the rate unchanged at 2.3%.

Monday’s move comes after the People’s Bank of China signaled this month that it was downplaying the role of the medium-term lending facility as a policy tool, while raising the seven-day reverse repurchase rate to greater prominence.

A day later, China will receive industrial profit figures that could prompt calls for further policy measures to boost the economy, and Beijing will see official PMI figures on Saturday.

Elsewhere, prices will be an issue.

Australia’s trimmed average inflation gauge for July will give its central bank fresh evidence to weigh as it considers whether to maintain its hawkish rhetoric.

Japan will also get an update on consumer inflation in the capital, a leading indicator of domestic trends. Friday’s data could show India’s year-on-year economic growth slowed a bit in the second quarter, and trade figures from Thailand, Sri Lanka and Hong Kong are due later in the week. Kazakhstan’s central bank meets on Thursday to decide whether to cut its key rate for a third straight meeting.

Europe, Middle East, Africa

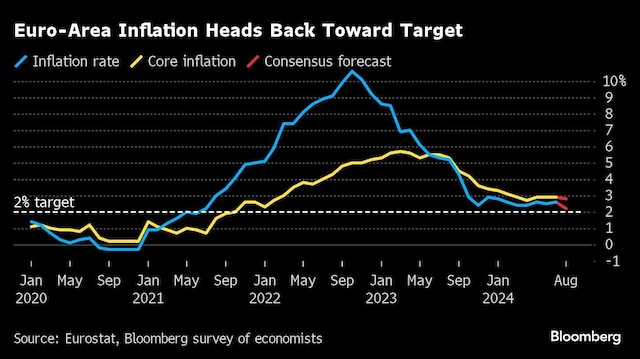

Inflation data will also be in focus in Europe, with August figures from the region’s major economies (Germany, France, Italy and Spain) due, along with a reading for the 20-nation eurozone as a whole.

The bloc is expected to slow from 2.6% in July, paving the way for the ECB to cut interest rates for a second time this cycle when it meets in September.

These expectations have been reinforced by the continent’s difficult economic situation. While the August purchasing managers’ index received an unexpected boost in the wake of the Paris Olympics, underlying weakness is likely to persist beyond that temporary boost. Updates on output and confidence in Germany, the region’s current weak spot, are due early in the week.

Speakers likely to comment on monetary policy and the latest developments in the economy include ECB Governing Council members Joachim Nagel and Klaas Knot, as well as Executive Board member Isabel Schnabel.

In Eastern Europe, Hungary is expected to keep interest rates unchanged at 6.75%. The same is true in the Middle East, where Israel’s central bank is expected to keep benchmark borrowing costs at 4.5%.

In Africa, August inflation figures for Kenya and Uganda will be released, along with second-quarter GDP figures for Nigeria.

Latin America

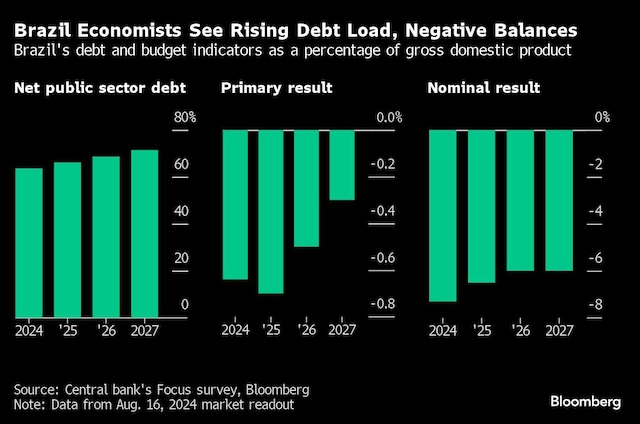

Brazil’s central bank releases its weekly survey of economists on Monday. Bank President Roberto Campos Neto said this month that inflation expectations are not anchored and that officials are willing to tighten monetary policy if necessary.

Brazil’s mid-month inflation data, due on Tuesday, could show a slight decline from July’s 4.45% but is still well above the 3% target. Analysts are revising their interest rate forecasts upwards, while traders expect a hike next month.

The fiscal slip has put Brazil’s budget data (July figures due next week) in the spotlight. Economists surveyed by the central bank do not expect an annual nominal or primary budget surplus until the 2027 forecast horizon.

The main event in Mexico will be the central bank’s quarterly inflation report. New forecasts are unlikely to be published so soon after revisions made in the statement following the bank’s decision on August 8, but policymakers could re-examine GDP estimates.

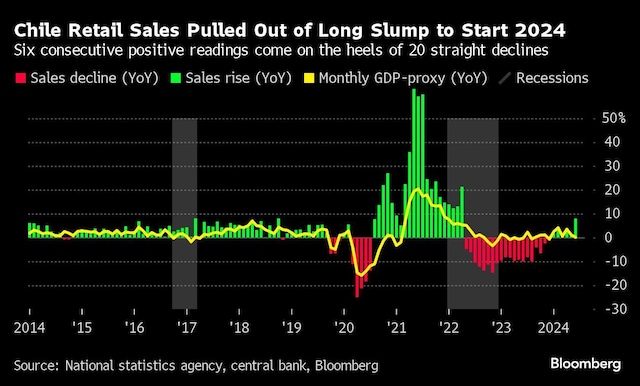

Chile’s June retail sales figures will likely show a seventh consecutive positive year-on-year figure after nearly two years of declines.

First published: August 25, 2024 | 10:52 PM IS

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.