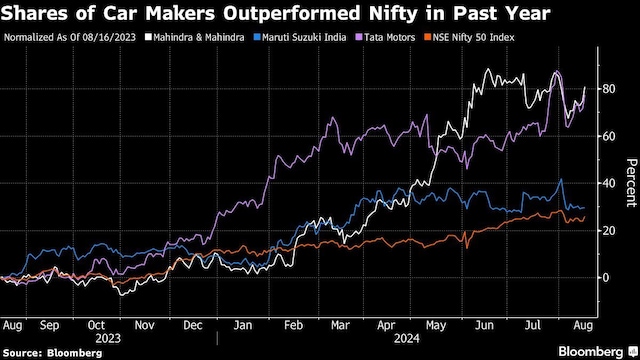

Over the past 12 months, the NSE Nifty Auto index has gained 66 percent, compared with a 26 percent rise in the broader benchmark. Photo: Bloomberg

A soaring rally in Indian auto stocks is reversing as a backlog of unsold vehicles and rising discounts from carmakers put pressure on profit margins.

India’s NSE Nifty Auto index has fallen 4.1% in August, more than double the decline in the Nifty 50 index. Benchmark Maruti Suzuki India Ltd. has fallen 6% so far this month, on track for its worst monthly performance since December 2022.

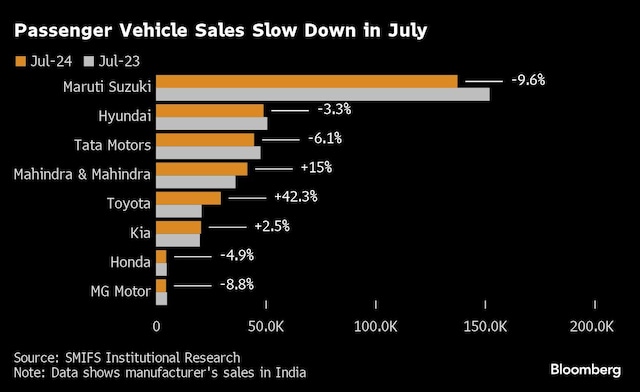

Passenger vehicle inventories have risen to record highs of up to 72 days, the Federation of Automobile Dealers Associations said last month. The waiting period for some models, which was up to 12 months a year ago, has virtually disappeared, according to MRG Capital. Increased competition among automakers has also led to price cuts. These factors have raised concerns about whether local automakers can maintain the strong sales seen after the pandemic.

“After such a rally there is a risk that these companies will see a correction,” said Manu Rishi Guptha, portfolio manager at MRG Capital.

Over the past 12 months, the NSE Nifty Auto index has risen 66 per cent, compared with a 26 per cent rise in the broader benchmark.

There are still some relatively safer segments of the automotive market. “We are currently leaning more towards two-wheelers than four-wheelers,” said Deepika Mundra, an analyst at M&G Investments. Two-wheeled motor vehicles are better positioned to benefit from the transition to electric vehicles due to their higher market penetration, she added.

However, the much-anticipated IPO of Hyundai Motor Co.’s Indian unit could create additional surplus in the sector as investors get another option, Mundra said. The South Korean firm is set to raise a record amount of money in the country in what could be India’s largest initial public offering to date.

The next test of the market will be the festival season, which starts at the end of next month and is a peak season for car sales. Last year’s 42-day season saw record vehicle sales, with nearly 550,000 cars sold in that period, an increase of around 10 percent from the previous year.

However, there is little expectation of a turnaround. Demand for entry-level cars has not seen a major pick-up and carmakers are selling more stock ahead of the season, said Amit Hiranandani, an analyst at Smifs Ltd.

“Distributor confidence suggests that sales for the upcoming festival season may be flat or lower than last year,” he added.

First published: August 19, 2024 | 8:53 a.m. IS

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.