Following the October 25 Form C filing, XRP briefly fell below the psychologically significant $0.50 mark, but recovered on the same day and is currently trading above $0.51.

The token has fallen 15% since the beginning of the month, falling from $0.61 to the current $0.51. The biggest drop in price came on October 3 following news that the Securities and Exchange Commission was filing a notice of appeal in its long-running lawsuit against Ripple, challenging Judge Torres’ verdict that XRP is not a security.

While Ripple. Since both sides have since appealed parts of the August 2023 ruling, the drawn-out legal battle over the status of XRP appears to be keeping investors on edge.

At the same time, while XRP holders wait how cross-appeals will turn out for both sides, they are not rushing to sell. According CryptoQuantumRecent foreign exchange inflows had been minimal, standing at $10 million as of October 28, a far cry from this month’s peak of $15 billion on October 20. The data suggests that many investors may have taken a “wait and see” approach rather than reacting immediately to each legal update.

Forex inflow tracks the amount of cryptocurrencies, such as XRP, being transferred into forex wallets, making it a useful metric for gauging market sentiment. Large amounts of cryptocurrency flowing onto exchanges would generally mean that holders are preparing to sell, which could drive the price of the asset lower. The current low inflows suggest that more holders are now committed to HODL, as most of the selling pressure was exhausted earlier this month when the SEC filed an appeal idea.

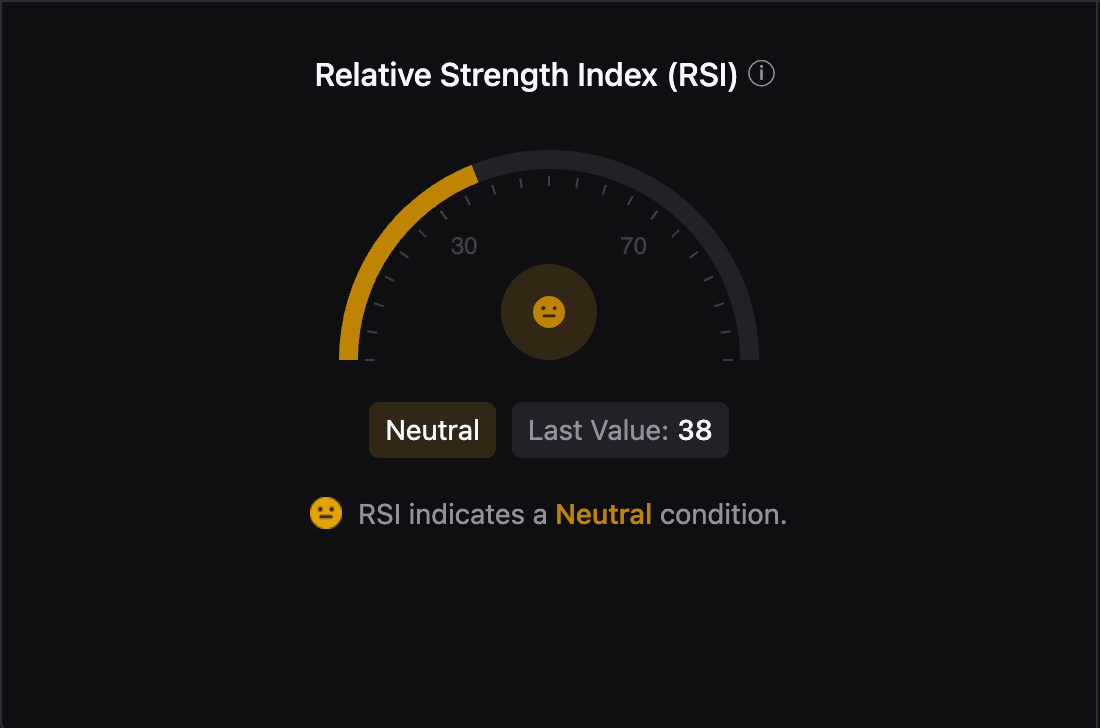

The Relative Strength Index also suggests that selling pressure is easing, setting up XRP for a potential price surge. The current RSI at 38 is slightly above the “oversold” threshold, so an upside reversal is not out of the question if the metric falls below 30. For now, it appears that XRP may still be under some selling pressure and that the bottom may be waiting for the bullish change.

The RSI is one of the most popular tools used in cryptocurrency trading to identify oversold or overbought conditions. Represented as an oscillator, the indicator takes values in a range from zero to 100, where values below 30 suggest an oversold situation, while values above 70 indicate overbought territory.

Ripple appeal opens new chapter in protracted legal fight

On Friday, Ripple Chief Legal Officer Stuart Alderoty confirmed in a post on Twitter/X that the company filed a Form C with the United States Court of Appeals for the Second Circuit to appeal parts of Judge Torres’ ruling. The movement follows the notice of cross-appeal introduced by the company earlier this month.

The appeal challenges the court’s ruling that its institutional sales of XRP constituted an unregistered securities offering, which resulted in a $125 million fine for the company. Ripple specifically disagrees with the court’s application of the Howey test, a framework created by the Supreme Court to determine whether a transaction qualifies as an investment contract.

The company also argues that Judge Torres in her ruling overlooked the broader regulatory uncertainty surrounding the application of securities laws to digital assets. The SEC also failed to provide fair notice that XRP sales violated those laws, Ripple claims. The filing requests a de novo review of the case, meaning the appeals court will reexamine it from scratch, without relying on previous findings or conclusions.

Alderoty emphasized that the SEC’s appeal does not challenge the district court’s ruling that XRP itself is not a security, a decision that remains a historic victory for Ripple.

“As we move forward in this process, remember the SEC’s broader strategy: to attempt to create distraction and confusion for Ripple and the industry. But honestly, it’s just background noise now. The difficult part of the fight is behind us. “Ripple’s business is growing and getting stronger every day even as this appeal process unfolds,” the lawyer added.

Former SEC lawyer shares regulator’s perspective

Meanwhile, former SEC official Ladan Stewart took the stage at Crypto Investor Day, an event hosted by entrepreneur and Bitcoin bull Anthony Pompliano, to talk about lessons learned after eight years at the agency. Stewart, who was part of the SEC’s high-profile cases against Coinbase and Ripple, now helps defend crypto clients he was once litigating against.

“When you get to this side and you realize that there are people who really want to find a way to work with regulators, and they feel that that’s just not possible, given that you know who’s running the SEC or, in general, of Biden. administration. “I think it’s just unfortunate and it hinders any effort to achieve some regulatory clarity or anything that would allow us to work to build this industry,” Stewart said, quoted by Fox Business’ Eleanor Terrett.

Stewart’s moment of revelation about cryptocurrency companies actually hoping to work with regulators was met with predictable mockery from Twitter/X’s cryptocurrency lawyers. Uniswap CLO Katherine Minarik noted that finding a way to work with regulators was precisely what companies had been trying to do for years.

Others were quick to point out that the “revolving door” between the government agency and the private sector creates a tremendous conflict of interest and presents regulators as a group of mercenaries who no longer seem to care about the preached values of fair play and transparency. moment when they change sides.

Former SEC Enforcement Director Gurbir Grewal, who resigned from his position on October 11 after filing more than 100 enforcement actions against the crypto industry during his 3-year tenure at the agency, now holds a position at Milbank LLP as litigation and arbitration lawyer. . Milbank is currently representing Binance in its case against the SEC that Grewal himself filed as an agency official.

Disclaimer:

The information contained in this post is for general information purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the post for any purpose.

We respect the intellectual property rights of content creators. If you are the owner of any material featured on our website and have concerns about its use, please contact us. We are committed to addressing any copyright issues promptly and will remove any material within 2 days of receiving a request from the rightful owner.